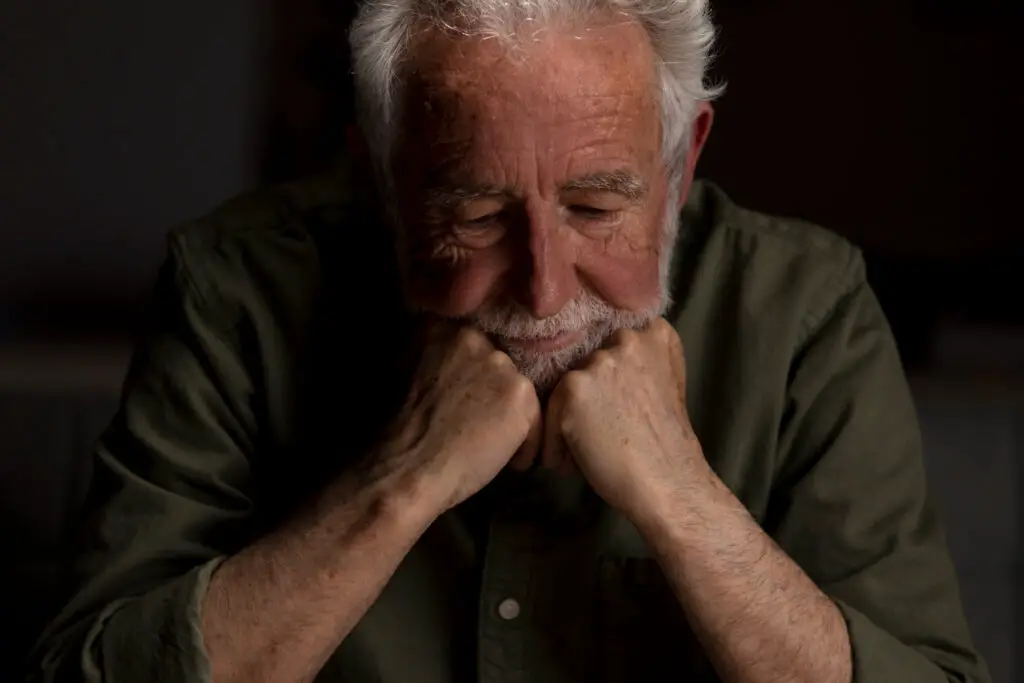

What Boomers Fear Most: 8 Things That Keep Them Up at Night

Growing older brings wisdom, perspective, and the freedom to enjoy more of life on your own terms. But if we are being honest, it also comes with a new set of worries that tend to creep in when the lights go out. Baby Boomers have lived through decades of social change, economic highs and lows, and technological revolutions. Yet no matter how much resilience you have built up, there are still those nagging fears that can keep you staring at the ceiling at 2 a.m.

The truth is, many of these concerns are not unique to you. Millions of Baby Boomers across the United States share the same late-night anxieties. The good news is that by recognizing them, you can start to prepare, adjust, and even laugh a little at the things that feel overwhelming. Let’s take a look at eight of the biggest fears Baby Boomers face today—and what can be done to put some of those worries to rest.

1. Outliving Their Savings

If there is one worry that tops the list for Baby Boomers, it is the fear of running out of money before running out of time. After decades of working hard, saving diligently, and weathering economic ups and downs, the idea of watching retirement funds slowly drain away is unsettling. Add inflation into the mix, along with longer life expectancies, and it is no wonder this concern keeps many awake at night.

The key here is not just saving money, but learning how to make it last. That means having a clear spending plan, considering options like annuities or other income-producing investments, and making sure withdrawals from retirement accounts are sustainable. A trusted financial planner can help create a strategy that accounts for both longevity and flexibility. Planning now gives you more confidence later—and confidence is the best antidote to those midnight worries.

2. Declining Health and Chronic Illness

Few things feel as threatening as the possibility of declining health. While gray hair and laugh lines are badges of experience, health concerns are often harder to accept. Baby Boomers are living longer than previous generations, but that also means more years of managing conditions such as heart disease, diabetes, or arthritis. These health challenges can affect independence, energy, and even relationships.

The good news? Advances in medicine and preventive care make it easier than ever to stay healthier for longer. Regular screenings, a balanced diet, and staying active can go a long way toward keeping illness at bay. Taking charge of your health with small daily habits is empowering and can help shift the focus from fear to proactive living.

3. Rising Healthcare and Long-Term Care Costs

Even if you are healthy today, the thought of future healthcare costs can feel overwhelming. Medicare provides important coverage, but it does not pay for everything—especially when it comes to long-term custodial care. Nursing homes, assisted living facilities, and even in-home caregivers can be shockingly expensive. One unexpected medical emergency has the power to shake even the most carefully built financial plan.

Facing this fear head-on is the best defense. Research what Medicare covers, explore supplemental insurance options, and consider whether long-term care insurance or hybrid policies are worth the investment. Having a dedicated healthcare fund or at least a clear picture of potential costs can ease the fear of being blindsided. Preparation may not remove the expense, but it reduces the element of surprise.

4. Social Security and Pension Uncertainty

For many Baby Boomers, Social Security and pensions are cornerstones of retirement planning. But what happens if those benefits are reduced or do not stretch as far as expected? Rumors of changes to Social Security funding or uncertainty about pension stability can stir up plenty of stress. After years of contributing, the thought of not receiving what you earned can feel deeply unsettling.

While you cannot control government policy or corporate pension health, you can control how you prepare. Stay informed about updates from the Social Security Administration, know the details of your pension plan, and avoid relying too heavily on one single source of income. Building in other income streams, such as part-time work, investments, or rental income, can provide a stronger safety net.

5. Inflation and the Rising Cost of Living

Remember when a gallon of milk was under a dollar and gas was cheaper than a cup of coffee? Prices today can be downright shocking, and inflation makes fixed incomes feel tighter each year. Groceries, utilities, and medical bills do not stop rising simply because your paycheck has. For retirees, this steady creep of higher costs can feel like a constant threat.

While inflation is inevitable, there are ways to lessen its bite. Reviewing your budget regularly and trimming unnecessary expenses can help stretch your income. Investing in assets that grow faster than inflation, like certain stocks or real estate, can also provide protection. Flexibility is your greatest tool. Even small adjustments—such as cooking at home more often or shopping smarter—can make your money go further.

6. Being in the “Sandwich Generation”

Many Baby Boomers are caught in the middle, supporting both older parents and adult children at the same time. This role, often called the “sandwich generation,” is stressful financially and emotionally. Caring for a parent while also helping kids with college tuition, down payments, or unexpected bills can leave you feeling stretched thin. The guilt of saying no can weigh just as heavily as the strain of saying yes.

Setting clear boundaries is essential. Open conversations with family members about what you can realistically provide help manage expectations. Explore community programs, caregiver support services, and even tax benefits that may lighten the load. Remember that your own financial and emotional well-being matter too. You cannot pour from an empty cup, and sometimes the most loving choice is protecting your ability to stay steady for the long haul.

7. Losing Independence and Becoming a Burden

For many Boomers, one of the deepest fears is losing independence. The thought of giving up driving, relying on others for daily tasks, or feeling like a burden to family members is a difficult reality to face. Independence is tied closely to dignity, and when that feels threatened, anxiety is only natural.

Preparing early can help make this transition easier if it becomes necessary. Explore housing options that support aging in place, such as single-level homes or communities with built-in services. Keep important legal documents up to date, like advance directives and power of attorney. Stay socially active and maintain healthy routines to extend independence for as long as possible. Planning ahead ensures that when the time comes, the decisions are yours—not made in a rush by others.

8. Death and Legacy Concerns

Even the most practical Baby Boomers find themselves lying awake wondering: What will I leave behind? Will my loved ones be okay? Have I done enough to ensure things are in order? Thoughts of death and legacy are not just about money, but also about values, memories, and family harmony.

The most effective way to quiet this fear is through planning and communication. Draft or update your will, organize important documents, and make sure beneficiaries are current on all accounts. Consider creating a trust if it fits your situation. Just as important, talk to your loved ones about your wishes so there are no surprises. A thoughtful legacy is not only financial—it is also the stories, values, and traditions you pass on.

Final Thoughts

The worries that keep Baby Boomers awake at night are real, but they do not have to be paralyzing. Each fear becomes more manageable when met with action, preparation, and a healthy dose of perspective. Remember, you have already overcome countless challenges in your lifetime. Retirement and aging bring new ones, but they are not insurmountable.

Think of it this way: Fear thrives in uncertainty, but fades with preparation. By taking steps today—whether updating a will, adjusting a budget, or simply scheduling a doctor’s appointment—you are building a stronger, calmer future for yourself and your family. So the next time your mind races at night, remind yourself that you are not alone, and that even small actions can bring peace of mind.

After all, you have earned the right to rest easy.

Leave a Reply