6 Money-Saving Apps for Seniors (Actually Easy to Use)

Let’s be real: managing money today isn’t anything like it was 30 years ago. Back then, saving a buck meant clipping coupons from the Sunday paper, waiting for a double-coupon day, or keeping a trusty ledger for household bills. Now? Everything’s digital, and it can feel like you need a grandchild just to make sense of the apps.

But here’s the good news: not all modern money-saving tools are confusing or made for 20-somethings living on oat milk and gig work. In fact, there are some downright brilliant apps that are perfect for folks over 50—especially those who want to stretch their dollars without the hassle.

We’ve rounded up six easy-to-use apps that can help you save on everything from gas to groceries, prescriptions to streaming, and yes, even help track where all your money’s going. And don’t worry—they’re not tech nightmares. If you can send a text or check your email, you can use these.

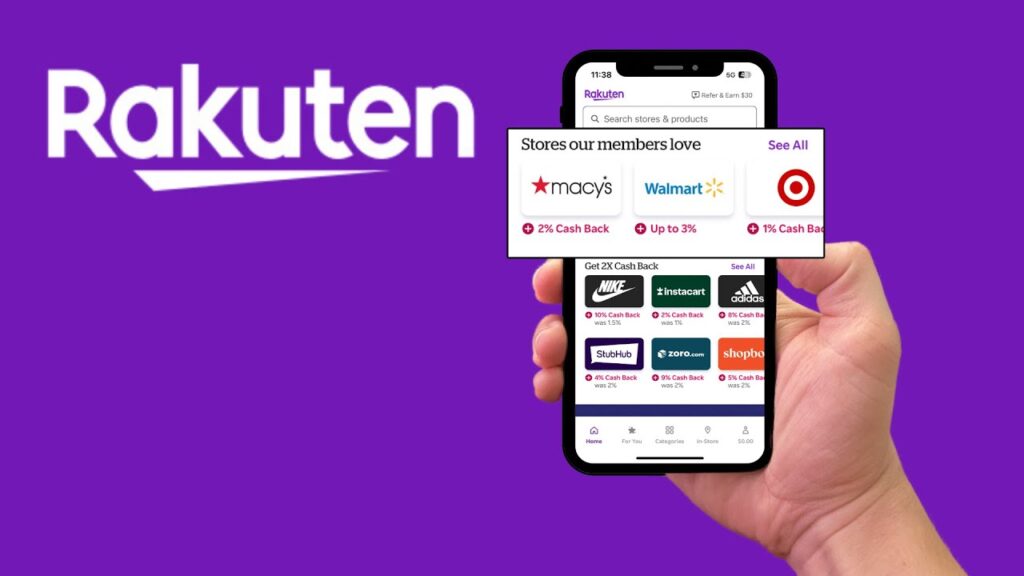

1. Rakuten – Get Cash Back Without Remembering Coupons

You don’t need to be a shopaholic to love Rakuten. This app makes saving money feel like a reward, not a chore. Every time you shop online through Rakuten—from big-name stores like Macy’s, Walmart, Target, and more—you get a percentage of your purchase back in cold, hard cash. That’s it. No code to remember, no digital coupon to apply. Just click through Rakuten before you buy and earn money back automatically. They’ll even send you a check or deposit your earnings into PayPal every quarter. For seniors who prefer simplicity and a little extra boost to the budget, this is an easy win.

2. GoodRx – Prescription Prices That Won’t Give You Sticker Shock

Let’s face it—prescription prices in the U.S. can be outrageous. If you’re not on Medicare yet (or even if you are), GoodRx can help you slash those pharmacy costs. Just type in your medication, and the app instantly shows you the prices at local pharmacies—plus free coupons that can save you up to 80%. You don’t need to sign up for anything fancy, and you don’t need to ditch your insurance. GoodRx simply shows you where to get the best deal. Seniors juggling multiple prescriptions can save hundreds a year using this free, no-fuss app—and that’s worth every tap.

3. Flipp – Weekly Flyers in Your Pocket

Remember flipping through paper circulars from the grocery store? Flipp brings that same experience to your phone—minus the paper clutter. This app gathers all your local flyers into one searchable, user-friendly place. Looking for deals on coffee, eggs, or paper towels? Type it in and see where it’s on sale nearby. It even lets you create a shopping list that syncs with store discounts. It’s great for seniors who still love a good deal and want to compare prices before heading out. The large fonts and intuitive design make Flipp an absolute breeze to use—even if you’re not super tech-savvy.

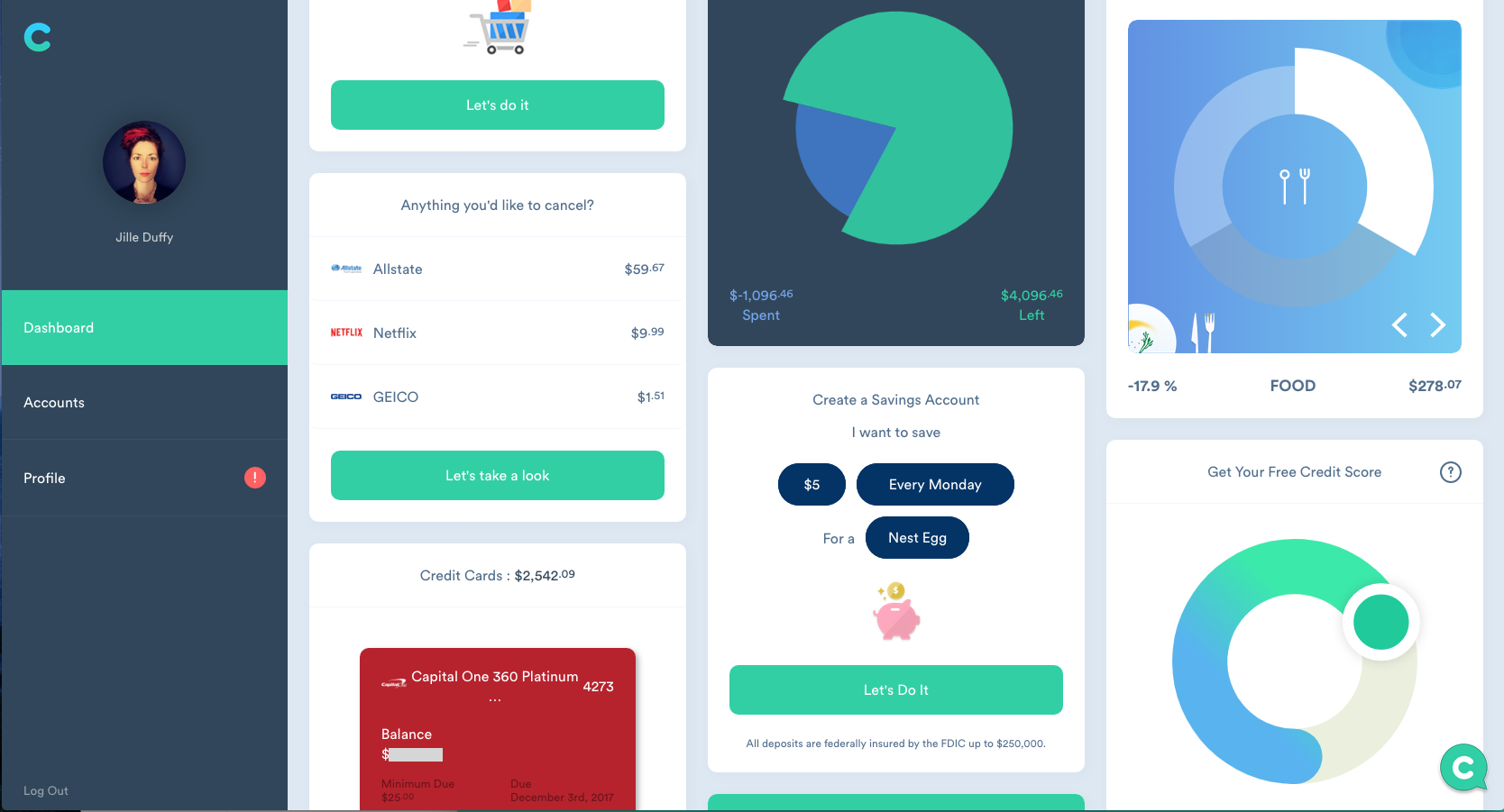

4. Mint – Know Exactly Where Your Money Goes

Budgeting sounds boring—until you realize just how much of your money vanishes into thin air each month. Enter Mint, the free budgeting app that acts like a personal financial assistant in your pocket. It links to your bank accounts and credit cards, automatically tracks your spending, and categorizes it into things like groceries, gas, dining out, or bills. You get a clear picture of where your money goes, along with helpful reminders when bills are due. For boomers who want to manage retirement income, Social Security, or just make smarter spending choices, Mint helps make cents (pun intended) of it all.

5. Upside – Real Cash Back on Gas, Groceries, and Dining Out

With gas prices always fluctuating and restaurant meals creeping up in price, Upside is the app that gives you real money back just for living your life. Find deals at gas stations, grocery stores, and restaurants in your area, tap to claim the offer, then scan your receipt or pay with a linked card—and boom, cash back. You don’t need to be a road warrior to benefit; even casual drivers and diners can rack up savings over time. It’s especially handy for retirees who enjoy road trips, errands, or supporting local restaurants. Bonus: the interface is simple enough that you won’t need to bug your kids for help.

6. Tubi – Cut the Cable, Keep the Shows

Let’s talk entertainment. Cable bills today are through the roof, and let’s be honest—you’re probably only watching a handful of channels anyway. That’s where Tubi comes in. It’s a completely free streaming app that gives you access to thousands of movies and TV shows—no subscriptions, no credit card, no tricks. Yes, there are a few ads, but nothing more annoying than regular TV. You’ll find everything from classic sitcoms and vintage westerns to modern crime dramas and romantic comedies. If you’ve been looking for a way to cut the cord and save $100 or more a month, Tubi is the answer. And it works on smart TVs, phones, tablets, or even a good old laptop.

Final Thoughts

If the word “app” makes your eyes glaze over, don’t worry—you’re not alone. But these six tools were chosen specifically because they make life easier, not harder. They don’t require a tutorial, they don’t flood you with spam, and they don’t require you to be glued to your phone. They’re just practical, simple, and surprisingly helpful ways to keep more money in your pocket.

For baby boomers navigating retirement, fixed incomes, or just trying to get more bang for your buck, embracing a little tech can go a long way. Whether you’re trying to lower your grocery bill, track your expenses, cut prescription costs, or ditch an overpriced cable plan, there’s something on this list for you.

So go ahead—download one, maybe two. Try them out for a week and see what sticks. The only thing you have to lose is a few unnecessary expenses. And who doesn’t love finding a little extra money at the end of the month?