10 Budgeting Apps Everyone’s Talking About for Saving Made Simple

Managing money has always been part of life, but the tools have changed dramatically. Baby boomers grew up balancing checkbooks, stuffing cash into envelopes for bills, and maybe even jotting expenses down in a trusty ledger. Fast forward to today, and we live in a world where our phones can track every penny for us, giving a clear picture of where our money is going. The problem is, with so many budgeting apps out there, it can feel overwhelming to figure out which ones are actually worth your time.

Here is the good news: budgeting apps are not just for the younger crowd. In fact, they can be incredibly useful for baby boomers who want to stretch their retirement income, monitor multiple accounts, or simply make sure that fun money for travel and grandkids does not mysteriously vanish. The right app can make saving simple, give you peace of mind, and help you feel in control without requiring a degree in computer science.

We have rounded up ten of the most talked-about budgeting apps in 2025. Each one has its own strengths, but they all share a common goal: helping you keep more money in your pocket. Let’s dive in.

1. YNAB (You Need a Budget)

YNAB is the budgeting app people rave about because it changes the way you think about money. Instead of just tracking what you spend, YNAB teaches you to assign every dollar a job. Whether that job is paying bills, saving for a trip, or covering emergencies, the system keeps you intentional. It may take a little practice to get the hang of it, but once you do, it feels empowering. For boomers living on fixed incomes, YNAB can be a game-changer because it ensures you know exactly where your money is going.

2. EveryDollar

Built by financial expert Dave Ramsey, EveryDollar is about as straightforward as budgeting gets. The app helps you give every dollar of your income a place to live, so nothing slips through the cracks. The free version is plenty to get started, but if you want automatic bank connections, the paid plan is available. Its clean design is friendly for beginners and great for anyone who wants a no-frills, effective budgeting tool. For baby boomers, it feels a little like the envelope method made digital but without the paper clutter.

3. PocketGuard

PocketGuard is like having a personal assistant who tells you exactly how much you have left to spend after covering your essentials. It connects to your bank accounts, tracks your income, and subtracts your bills so you can see what is safe to spend at a glance. If you like the idea of having your financial picture boiled down into a single number, this app delivers. It is especially handy for boomers with multiple income sources, like Social Security, retirement accounts, or part-time work, because it keeps the math simple.

4. Monarch Money

Monarch Money has earned a reputation as one of the best all-around budgeting apps. It gives you a bird’s-eye view of all your accounts—checking, savings, credit cards, and even investments—in one place. You can set up custom categories, track spending, and even build savings goals. For boomers, that big-picture perspective is incredibly valuable. It is not just about what you spend today, but how your finances are working together for the long haul. Monarch feels modern and sleek but still approachable.

5. Goodbudget

Remember when people used to tuck cash into envelopes for different expenses? Goodbudget takes that classic strategy and makes it digital. You create virtual envelopes for categories like groceries, dining out, or gifts and then track your spending from there. Couples can share the same budget, making it easier to stay on the same page financially. Many boomers love it because it feels familiar but with a twenty-first century twist. Plus, it encourages discipline without feeling restrictive.

6. Simplifi by Quicken

Quicken has been a trusted name in personal finance software for decades, and now Simplifi brings that expertise into a mobile-friendly format. Simplifi automatically categorizes your expenses, creates easy-to-understand dashboards, and even shows you spending projections. For those who liked the detail of old-school Quicken but want something less clunky, Simplifi hits the sweet spot. It is an especially good fit for boomers who appreciate both depth and convenience.

7. Tiller Money

If you are someone who feels more comfortable with spreadsheets, Tiller might be your dream budgeting tool. It automatically imports your financial transactions into Google Sheets or Excel and then organizes them with customizable templates. You get the flexibility of a spreadsheet with the automation of an app. Boomers who have tracked expenses in Excel for years often find Tiller refreshing because it keeps things familiar while saving a lot of manual work.

8. Qapital

Qapital makes saving money fun by letting you set creative rules that automatically move money into savings. For example, you could round up every coffee purchase to the nearest dollar and save the difference, or set a rule that every time you walk a mile, a few bucks go into your savings account. These little nudges add up over time, often without you even noticing. For boomers, Qapital can be a lighthearted way to grow savings without having to micromanage every transaction.

9. MoneyWiz

MoneyWiz is a robust tool that works especially well for Apple users. It supports budgeting, bill tracking, and detailed reports, and it syncs across devices so you can keep tabs on your finances from your phone, tablet, or computer. One standout feature is the ability to set recurring transactions, which is perfect for things like monthly utility bills or subscription services. For boomers who want a powerful but intuitive app, MoneyWiz is a strong contender.

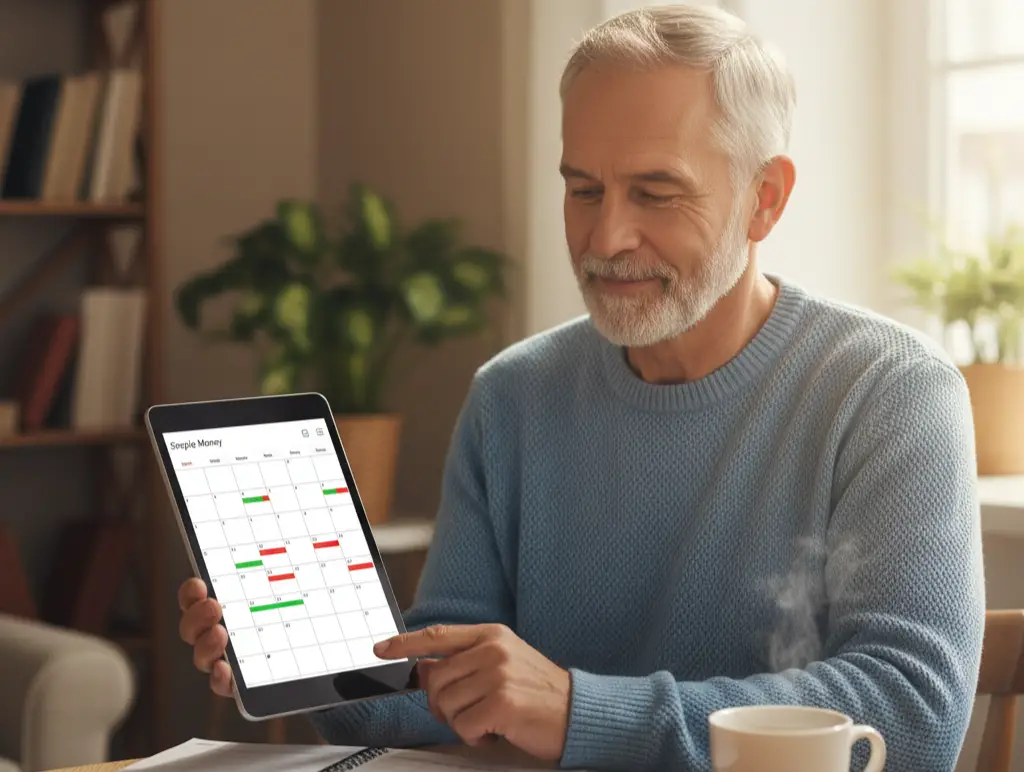

10. Simple Money

Simple Money, sometimes called Simple Budget, is built around a calendar view of your finances. Instead of abstract graphs or charts, you see your income and expenses mapped out day by day. This makes it easy to spot potential shortfalls before they happen. For baby boomers living on a fixed income, this kind of clarity is invaluable. You can quickly see whether the money will stretch through the month or whether adjustments need to be made.

Final Thoughts

Budgeting does not have to feel like a chore, and it certainly does not have to feel like punishment. In fact, with the right app, budgeting can be freeing. It gives you the confidence of knowing exactly where you stand, which means fewer surprises and more opportunities to enjoy life.

For baby boomers, this is especially important. Whether you are living on retirement income, working part-time, or just trying to stretch your dollars further, these apps can make the process simple and even enjoyable. From old-school strategies like virtual envelopes to modern dashboards that track every penny, there is truly something for everyone.

So why not give one a try? Commit to using it for a month and see what changes. You may find that saving is easier than you imagined, and that peace of mind is worth every tap on the screen. After all, the goal is not just to manage money—it is to make money work for you so you can focus on what really matters: enjoying life, family, and the freedom you have earned.

Leave a Reply