8 Financial Habits That Separate Savvy Savers from Big Spenders

Ever wonder why some people always seem to have their money in order—while others can’t figure out where their paycheck disappears? It’s not luck. It’s not even about earning more. The real secret lies in daily habits.

Savvy savers think differently. They plan ahead, stay mindful of their spending, and use smart strategies that make their money work for them. Meanwhile, big spenders often live for the moment, swiping cards without much thought about tomorrow.

If you’ve ever wished you could save more without giving up the things you love, you’re in the right place. Let’s break down eight simple yet powerful financial habits that can turn anyone into a smart, confident saver—no complicated math required.

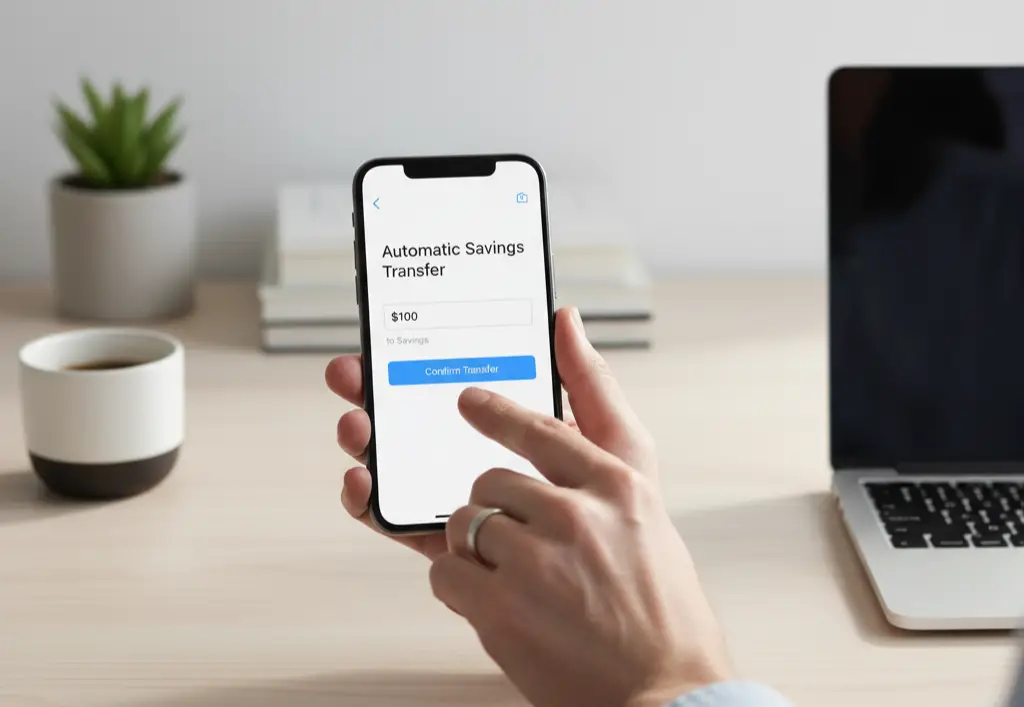

1. Automate Your Savings Before You Spend

One of the smartest moves a saver can make is setting up automatic transfers to savings right after payday. This removes the temptation to spend first and save “whatever’s left.” Think of it as paying your future self first. Even small, consistent transfers—like $50 or $100 each payday—can add up faster than you’d expect. Automation takes the effort out of saving and helps you build wealth quietly in the background, without you having to constantly think about it.

2. Set Clear Financial Goals You Can Actually See

Big spenders often spend without direction, while savvy savers always know what they’re working toward. Whether it’s a vacation fund, emergency savings, or early retirement, setting clear goals gives every dollar a purpose. It’s much easier to resist impulse buys when you can picture what that money could be doing instead. Try writing your goals down or using a visual tracker—seeing your progress builds motivation and keeps you focused on what truly matters.

3. Track Spending Like It’s a Game, Not a Chore

Let’s be honest—nobody gets excited about spreadsheets. But tracking your spending doesn’t have to feel like punishment. Savvy savers make it fun by treating it like a personal challenge: Can you spend less on takeout this month? Can you find that forgotten subscription and cancel it? Use an app or notebook, whatever feels easiest. The point is to know where your money’s going. Awareness is power—and it’s the first step toward making smarter choices.

4. Know the Difference Between Needs and Wants

Savvy savers understand that saving money doesn’t mean saying no to everything fun—it just means saying yes to what really matters. They make conscious decisions about where their money goes. They cover their essentials first—like rent, bills, and groceries—and then allocate a portion of their budget to things that bring genuine joy. Big spenders, on the other hand, tend to blur the line between wants and needs, which can quickly lead to financial stress. By creating room for both responsibility and enjoyment, you’ll find a healthy balance that keeps your finances on track and your lifestyle fulfilling.

5. Use Credit as a Tool, Not a Trap

Credit cards aren’t evil—they’re just misunderstood. Savvy savers use them strategically: paying balances in full, earning rewards, and building credit history without paying a cent in interest. Big spenders, however, often let balances roll over, racking up high interest that eats away at future income. The key is self-control. If you treat credit as a convenience rather than a crutch, you can enjoy its benefits while staying out of debt. Think of your credit card as a financial tool that works for you, not against you.

6. Build an Emergency Fund Before Chasing Big Dreams

Before you start investing, traveling, or upgrading your car, there’s one goal that every financially secure person has mastered: the emergency fund. Life has a way of surprising us—car repairs, medical bills, job changes—and without a cushion, even small setbacks can send you into panic mode. Savvy savers make sure they have at least three to six months’ worth of expenses tucked away. That fund isn’t just for emergencies—it’s peace of mind in a savings account. It gives you freedom and flexibility, so you can make smart decisions without fear.

7. Focus on Growing Your Money, Not Just Saving It

Saving is important, but parking all your money in a low-interest account won’t help it grow. Savvy savers know how to make their money work harder through investing, side hustles, or employer retirement plans. They understand that every dollar has earning potential. The earlier you start, the more compound interest works in your favor—turning small contributions into something substantial over time. You don’t have to be a financial expert to invest wisely; start small, stay consistent, and let time do the heavy lifting.

8. Review and Adjust Your Finances Regularly

Your financial life isn’t static, and your habits shouldn’t be either. Savvy savers treat money management like an ongoing relationship. They check in monthly or quarterly to see what’s changed—income, bills, goals—and adjust accordingly. Maybe you got a raise (time to save more), or maybe your grocery bill crept up (time to tweak the budget). Regular reviews help you stay aligned with your goals and catch small problems before they become major setbacks. Think of it as your money checkup—a way to keep your finances healthy and thriving.

Final Thoughts

Here’s the truth: being a savvy saver isn’t about perfection—it’s about consistency. It’s not about cutting every luxury or never treating yourself. It’s about building habits that give you control, clarity, and confidence with your money.

Every time you automate a deposit, skip an unnecessary purchase, or check in on your goals, you’re quietly building financial freedom. You’re proving to yourself that money doesn’t have to control you—you can control it.

If you feel like a “spender” today, remember: habits can change. Start small. Pick one of these eight strategies and practice it this week. Once it sticks, add another. Over time, those small changes will compound—just like your savings.

Savvy savers aren’t born that way—they’re made, one smart decision at a time. So start now, stay intentional, and watch how much calmer, stronger, and more secure you feel about your financial future. Because the real reward of saving isn’t just the balance in your account—it’s the peace of mind that comes with knowing you’re prepared for whatever life throws your way.

Leave a Reply