As more people shop online, price matching and comparing prices seems a little easier. But what happens when an item goes on sale after you’ve purchased it? Paribus will help you get a refund and put that money back into your pocket.

As more people shop online, price matching and comparing prices seems a little easier. But what happens when an item goes on sale after you’ve purchased it? Paribus will help you get a refund and put that money back into your pocket.

Sound too good to be true? I thought so too. In the one week that I used Paribus, I shopped online exclusively. Before I get into the nitty gritty, I’ll tell you how much I saved…a whopping $12. Now, this may not seem like much to you, but my Paribus review isn’t just about the money that I’ve saved.

Paribus Explained

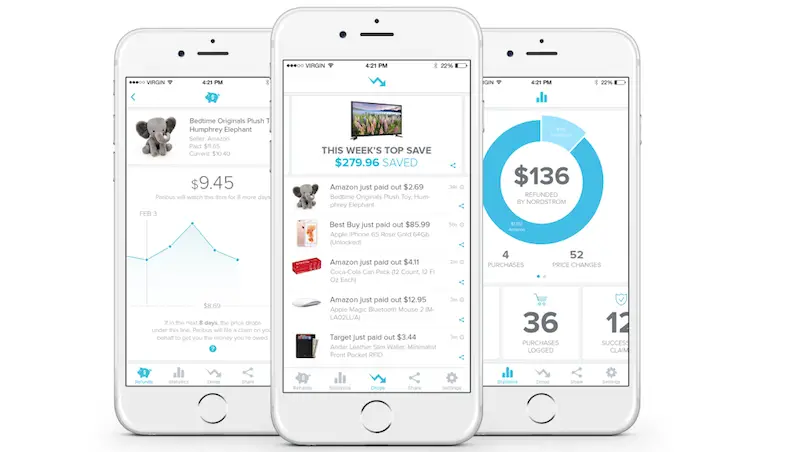

So what exactly is Paribus? Paribus is a website and app that monitors your purchases through your email and alerts you when an item that you bought drops in price. In return, they will file a price adjustment on your behalf and give you a refund.

This means the app can be a real way to save money if you primarily shop online. But is it worth it if you don’t? Let’s discuss the upsides first.

Paribus Review: Pros

What are some pros for Paribus?

Free To Use

Paribus is free to use. They don’t charge you to sign up. So, there is no financial cost to having the app on your smartphone.

Ease Of Use

I was pleased to see how easy Paribus was to use. Both the sign up process was easy and the apps interface was smooth and intuitive. All I did was enter in my email. In less than 5 minutes I was ready to save money! The great thing about Paribus is that it basically does all of the work for you.

If you are someone that hates checking for deals, Paribus could become your new best friend. Once it is installed, you don’t have to worry about checking around and trying to find rock bottom prices. Instead, Paribus will check everything on your behalf, and you’ll still the see the savings. Cool, right?

Savings

In my one week of using Paribus, I saved $12. I knew I would be testing out the service for my Paribus review, so I saved all of my purchases for test week. So, I bought an electric hand mixer, a new rocking chair, and a semi-expensive coat to prepare for next winter. I also bought a few household items, as well as pantry staples.

In all, I paid around $250 and saved $12. Considering the fact that I only gave the app a week to work, I’m satisfied with the savings. If I let it continue to monitor my purchases, I should see more savings in the future.

Works Well With Retailers

Besides a slight mishap with Amazon, I was able to use Paribus with just about every retailer! Here are all the stores Paribus works with. The stores are subject to change.

Paribus Review: Cons

Despite being easy to use and a proven money saver, Paribus does have some downsides that merit mentioning.

Availability

Paribus is not currently available on Android. I’m an avid Android user. When I first went searching for the Paribus app, I couldn’t find it. Thinking I made a mistake, I did some research online. I found that an app had been released for Android, but was removed by the time I tried to use it.

This is one of the biggest cons in my Paribus review, mainly because I use my phone a lot. I like the idea of having it on my phone and getting notifications when I’ve saved money. The good thing is that I can easily use this app on my computer. If you are an iPhone user, you can get the app for free on the app store.

Sign Up Options

If you are wary of giving someone access to your email, Paribus may not be the app for you. The app monitors your receipts by using your email. It then scans the receipts you receive and keeps the items stored so it can know when they drop in price.

Giving Paribus access to my email didn’t bother me at all, but I understand there are some people that are more private about their information, which is why I’m adding this as a con for my Paribus review.

Paribus Review: My Conclusions

So there you have it, my Paribus review! Overall, I think Paribus is an easy way to save some cash on purchases that you make online. As long as you are comfortable sharing your information and can work around the fees, you will enjoy this app!

If you want to sign up for Paribus please use this link. It will help us keep bringing you amazing content on this site. 🙂

Leave a Reply