The other day I received an excellent question from a reader, and I thought it would be best to answer the question publicly so that everyone could benefit.

This gave me the idea to make this question and answer format a regular series on the blog.

So today is the first installment of Monica’s Two Cents!

If you have a question for me, I would love to hear it. You can fill out the form on the Contact page or send me a message via Facebook or Twitter.

Now here is today’s question:

“Hey, Monica. I recently received an updated physical credit card in the mail. It’s from an old card that I haven’t used in several years. I never closed it because I heard that it’s better to keep it open and just not use it — better for my credit score. What are your thoughts on that? Should I verify it and keep it locked up or just close it out?”

This is a common issue people encounter as they embark on their debt free journey.

In order to understand the effect closing out the credit card may have on your credit score, we first need to understand what the credit score is and which factors are involved in the calculation.

What is a credit score and how is it calculated?

According to myfico.com, “A credit score is a number that summarizes your credit risk, based on a snapshot of your credit report at a particular point in time.”

The most commonly used credit score is calculated using software created by the Fair Isaac Corporation, also known as FICO. Banks and other potential lenders use your FICO® score to evaluate your credit history and assess if you are a good risk.

FICO® scores range from 300 to 850, and theoretically, the higher your score, the lower potential risk you impose on your creditors.

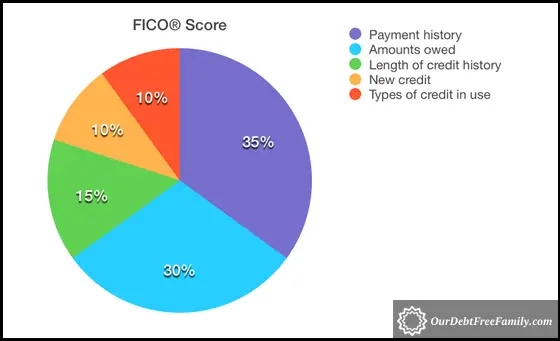

Your FICO® score is determined and weighted by the following five factors:

- Payment history — approximately 35%

- Amounts owed — approximately 30%

- Length of credit history — approximately 15%

- New credit — approximately 10%

- Types of credit in use — approximately 10%

Your FICO® score is entirely determined by your debt history and current debt position. It does not take into consideration any assets you own.

Therefore, it completely disregards your net worth, the size of your emergency fund, or how much wealth you have accumulated in other savings and investment accounts.

How will closing my credit card affect my credit score?

It is important to note that positive credit information remains on your credit report for ten years, and negative credit information remains for seven years.

As a result, if you close a credit card with a zero balance and no negative history, it will stay on your credit report for ten years. However, if it does have negative information associated with it, that information will fall off your credit report after seven years.

A critical variable in the calculation of your credit score is your balance-to-limit ratio, also known as your utilization ratio. This equation compares your total amount of debt incurred to your total amount of credit available.

A high utilization ratio indicates that you may be under financial stress and could be a higher credit risk to lenders.

According to Craig Watts, public affairs manager for FICO, “To close card accounts without impacting one’s credit score, you need to have zero balances on your credit report for all of your active credit cards. That’s because if you have zero balances, your credit utilization rate is therefore zero, and you can’t raise it — and potentially hurt your score — by closing one or more of the active card accounts.”

What about the credit card’s age? How does that affect my score?

It makes sense that the longer your credit history has been positive, the better your credit score will be. Therefore, if you close out a long-term credit card in good-standing, your credit score may eventually take a hit because your utilization rate has increased.

As mentioned above, however, even if the account is closed, the information will still remain on your credit report for ten years.

It is difficult to estimate how great the impact may be. Each person’s credit history is different and a variety of factors are involved. Closing out an old credit card may impact one person’s credit score more than another’s.

Monica’s Two Cents

Now that we have looked into how closing out the credit card may affect your credit score, we are ready to dig a little deeper.

I think the more important question is this:

How concerned are you about your credit score?

You only need good credit if you are planning on incurring more debt.

Do you see yourself refinancing your mortgage, taking out another car loan, or applying for some other type of financing in the future?

If so, then your best option may be to just leave it open and let it sit.

If not, then close the account and don’t think twice.

When my husband Mike and I were starting our debt free journey, we got really excited and started closing out all of our credit cards except for the one we currently use. We considered that closing out our old cards may negatively affect our credit scores, but here’s the thing —

We are not planning on going deeper into debt. We are done with debt. Our goal is to pay off all of our debt, including our mortgage, by the time we turn forty.

When we buy a new car one day, we will pay with cash.

If we ever move and buy a new house one day, we will pay with cash.

When we go on an exotic vacation and travel the world one day, we will pay with cash.

We do not plan on ever needing a good credit score again. We are not concerned about our credit scores. But since we are continually working to reduce our balance-to-limit ratio, I am sure that we are increasing our credit score in the process.

And what happens after we pay off our mortgage and no longer have any debt or credit accounts?

Our credit score will slowly dwindle. It will decrease over time, and sometime within ten years after making our last mortgage payment, our score will drop to zero.

Yes, zero.

And we’re okay with that.

We don’t need a credit score to survive.

When we are debt free with a fully-funded emergency fund, a paid-for house, two paid-for cars, and incomes that we get to do whatever we want with, incurring more debt will be the last thing on our minds.

What About You?

Participate in the conversation. How would you answer this question? What would you do with the credit card? Share in the comments below.

Since we are talking about credit card, I have another question. I’m sorry if you already answered to it, but we don’t have the same opinion with my husband.

For me to get good credit score you need to pay it off in full every month. For my husband you need to leave credit on it, even just a little bit to increase your credit score… Do you know what is the truth?

Credit scores is something so complicated for me and weird… in France you can make loans depending on the money you own and most of the people try to make any loans or have any debt at all in their entire life. Here it’s the opposite!

Hi, Julie! Thanks for the question. I have always thought that it is best to pay off the credit cards in full every month. This would lower your utilization ratio which is more favorable to potential lenders.

That is interesting about France! It sounds like they have things figured out over there!

We have 2 credit cards – one for everyday personal living uses (that we pay out each month) and the other is purely a safety net that we don’t have anything owing on but is there “just in case” one of those emergency “large” expenses crop up that is unforseen. Wonder if credit ratings are the same in Oz compared to the US ??

That’s a great question, Brian! I have no idea how credit scores work in Australia.

Credit cards are a convenient way to pay for things plus they provide added protection for some purchases. However, not properly managed, one can get into trouble. So I have two: one for personal use (really only in emergency cases) and then one for business purchases which is paid back each month in full.

I’m glad to hear that you pay your credit cards off in full when you use them, Ursula! We have one that we use and pay off each month.

This is such a thorough response! Another thing to keep in mind is that the more open credit cards you have, the more opportunities scammers have to steal your financial identity. If you never ever use a card, you may be more likely to miss unusual activity on the card. And THAT would negatively impact your FICO score, too!

Thank you, Catherine! That is a great point! Definitely something to keep in mind when deciding what to do with any old credit cards.

I have all my credit cards linked to my Mint account, even if I don’t use it, so it allows me to check if I have some weird activity on it

Thank you for this! I had been wondering about that myself.

You’re welcome, Mary! Glad you liked this post.