Have you ever heard of a money challenge? It is something the internet thought up a few years ago that helps people meet savings goals (usually within a specific period of time). The original challenge, the 52-week money challenge, helps people save right around $1,400 over the span of a year. However, that method and timeframe don’t work for everyone. If that includes you, here’s how you can hack the 52-week money challenge…

About the 52-Week Money Challenge

First, before we talk about hacking the challenge, you should have a good understanding of what the 52-week money challenge actually is. It was created online to help motivate people to increase and track their savings. Along with it came message boards and forums for support with people doing the same thing. Pretty cool, right?

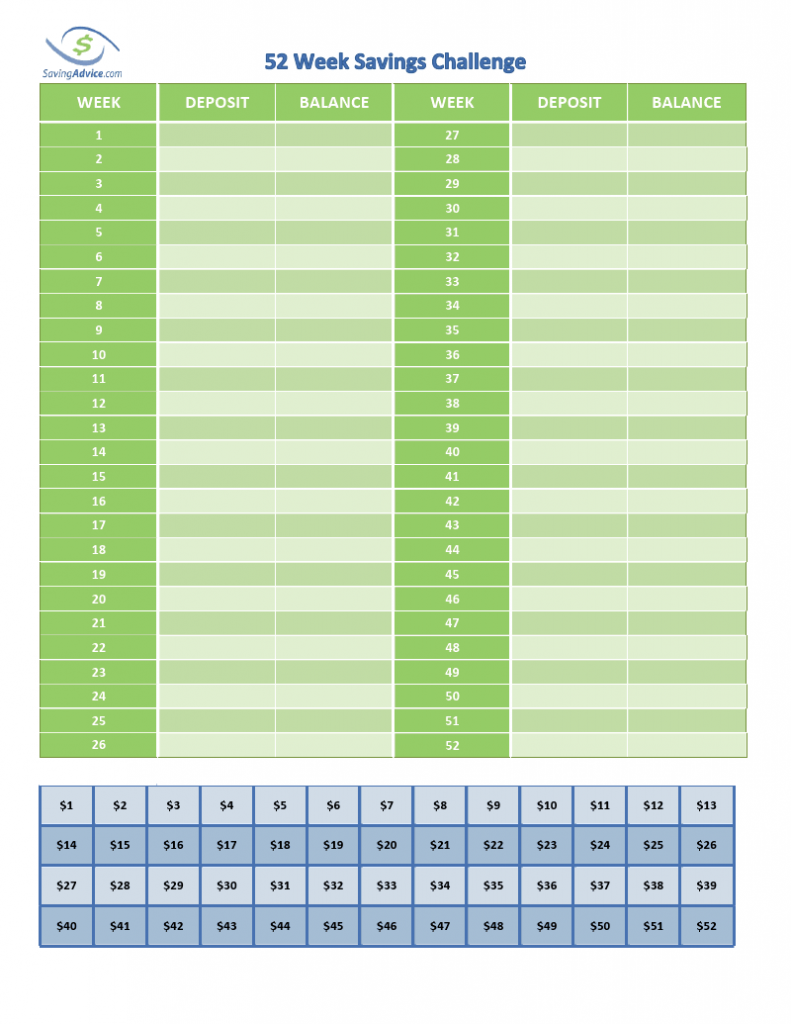

The challenge also introduced free printable tracking sheets where you can record your weekly savings. It also walks you through how much should be saved each week.

With this challenge, you save an additional $1 per week (i.e. $1 on week one, $2 on week two, $3 on week three, and so on). You can see how this adds up in the graphic below (via Saving Advice).

How to Hack the 52-Week Money Challenge

“Hacking” an internet challenge like this is fairly easy. All you need to do is figure out what needs to change for the challenge to better suit your financial needs. Here are three ways you can do it…

- Change the contribution amounts. For instance, if $1,400 over the span of the year is too little for your savings goals, increase the weekly amount you deposit into savings. If the amount is too much, you can also decrease your contributions. Similarly, you can also switch around your contributions. Many people do the 52-week money challenge in reverse to account for holiday spending at the end of the year.

- Switch up your goals. You can also hack the 52-week money challenge by changing its objective. For example, most people use the challenge to save money. Instead, you could use the challenge to pay off debt. So, instead of saving $1 the first week, you’d add $1 to your current debt payments.

- Hustle. Lastly, you can “hack” the challenge by creating money to save. Let’s say you’re living paycheck-to-paycheck and there’s absolutely no way you are saving $1,400 this year. To hack that problem, you just need to find a hustle or sell things to create the cash to save.

Other Challenges to Try

Throughout the article, I’ve been referring to the 52-week money challenge, but that is far from the only internet challenge out there to try. No matter what your goals are, financial or otherwise, there is probably a challenge out there for you. Take a look at these other money challenges you may want to try…

- Save $1,000 With the 12-Week Money Challenge

- Every Penny Counts With the 365 Day Money Challenge

- Pay Off Debt With This Money Challenge

- Earn More Every Week With This Challenge

Leave a Reply