The purpose of this blog is to take you through the exact process that my husband and I have used to pay off more than $65,000 of debt in 11 months on a single middle class income.

To get you started on your journey, there are a number of things you need to do get your house in order.

1. Make a promise and get your spouse on board

2. Calculate your net worth

3. Review the checklist for a strong financial plan

4. Set your goals

5. Track your spending.

This posting is about a key part of the process in your debt payoff journey – developing a debt payoff plan using the debt snowball.

Subscribe Below and Get a “Jump Start Your Way Out Of Debt” Worksheet!

Now it is time to develop your payoff plan

This step is where you determine which debt you will pay off first, assuming you have more than one debt. We need to prioritize your debts so that you will focus on paying off one debt at a time.

If you make extra payments at one time toward all of your debts or even just a few, it will take much longer to realize significant results. This may lead to feelings of discouragement and frustration with the debt elimination process.

By focusing your energy on eliminating one debt at a time, you will see quicker results and earn a greater sense of accomplishment for all your hard work.

You will work on paying off the smallest balance first and make the minimum payments on each of the other debts.

Put as much money as you can each month toward the smallest debt.

Once that debt is paid off, you will cross it off (and celebrate!) and move on to the next debt on the list. Add the amount you have been paying on your first debt to the minimum payment for your second debt on your list and that becomes your new payment amount for your second debt.

This is called the debt snowball method. As you pay off the smaller debts, the amount of money you have available to pay off your bigger debts increases.

You will gain momentum as you rapidly cross the smaller items off your list. Paying off the smaller debts quickly gives you a series of “small wins.”

In his book “The Power of Habit” Charles Duhigg states, “Small wins fuel transformative changes by leveraging tiny advantages into patterns that convince people that bigger achievements are within reach.” Basically, this means that when you have a series of small wins and you see progress as your snowball grows, paying off the larger debts will feel more achievable.

By the way, Duhigg’s book is great, I recommend you pick up a copy if you get a chance.

Let’s look at an example

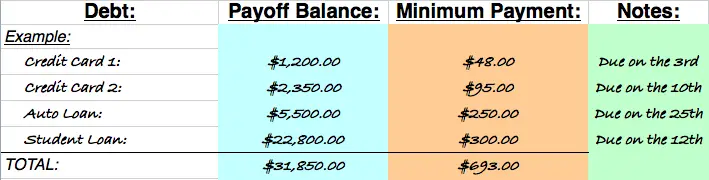

Let’s say your debt snowball looks like this:

Paying off your total debt of $31,850 probably feels overwhelming. Perhaps it is almost as much as your annual salary from your job. You might be thinking that it would be YEARS before you would be able to pay it all off.

And that might be true. It might be years but probably not as many as you think if you are intentional and focused on your goal.

Let’s say you work really hard in finding room in your budget (we’ll discuss strategies for this in a future post), and you are able to pay $500 toward Credit Card 1 each month while making the minimum payments on each of your other debts.

After two-and-a-half months, you have paid off Credit Card 1!

The following month you add $500 to the minimum payment for Credit Card 2. We’ll say that amount is $95. So in month four, you pay $595 toward Credit Card 2.

At that rate, it will take you about four months to pay off Credit Card 2.

After eight months, you have paid off two credit cards totaling $3,550!

Achieving those quick, small wins makes paying off your auto loan feel much more attainable. Your enthusiasm for paying off your debt has increased, and now you are even more motivated to pay off your auto loan as quickly as possible so that you can move on to paying off your last debt!

In month nine, your excitement spurs you to find an additional $100 in your budget so instead of adding $595 to your auto payment, you are adding $695 to your minimum payment of $250.

How long do you think it will take you to pay off your auto loan when you are making payments of $945?

Possibly only five months because your balance has decreased while you have been working your debt snowball even though you have only been making the minimum payment up until this point.

After thirteen months you have paid off three debts totaling $9,050, and you are able to add $945 to your minimum payment for your student loan!

Even though your student loan balance may still be over $20,000, you realize that in thirteen months, you have been able to pay off almost a third of your original debt total. And as your income increases over time, you will be able to pay even more toward your student loan each month.

In this scenario, I anticipate that it might take you another year-and-a-half to pay off the student loan. As a result, it has taken you two-and-a-half years to pay off your total debt balance of $31,850!

Exciting, right?

And it is completely doable.

This is the method my husband and I have used to whittle away more than $87,000 of debt in 20 months on a single income, but our numbers were much larger.

If we can do it, you can do it too!

Keeping Up The Momentum – Should You Refinance?

If you’re making good progress on your debt payoff and your credit is good, you might consider refinancing. If you’re going to do this you might consider going with a company like SoFi. They’ve been making waves with their low priced loans.

Leave a Reply