It’s that time of year again when people vow to be better than they were throughout the previous year. I, for one, am a fan of New Year’s resolutions for a number of reasons. The main reason I love the idea of resolving to do better is it gives everyone a fresh, positive outlook. As I’ve mentioned in the past, remaining positive has brought me a long way.

However, many people set goals and make resolutions that are simply not reasonable. For instance, if you have a lot of debt and little-to-no savings, it is unlikely that you will (or should) own a house by the end of the year. So, how do you go about creating reasonable resolutions?

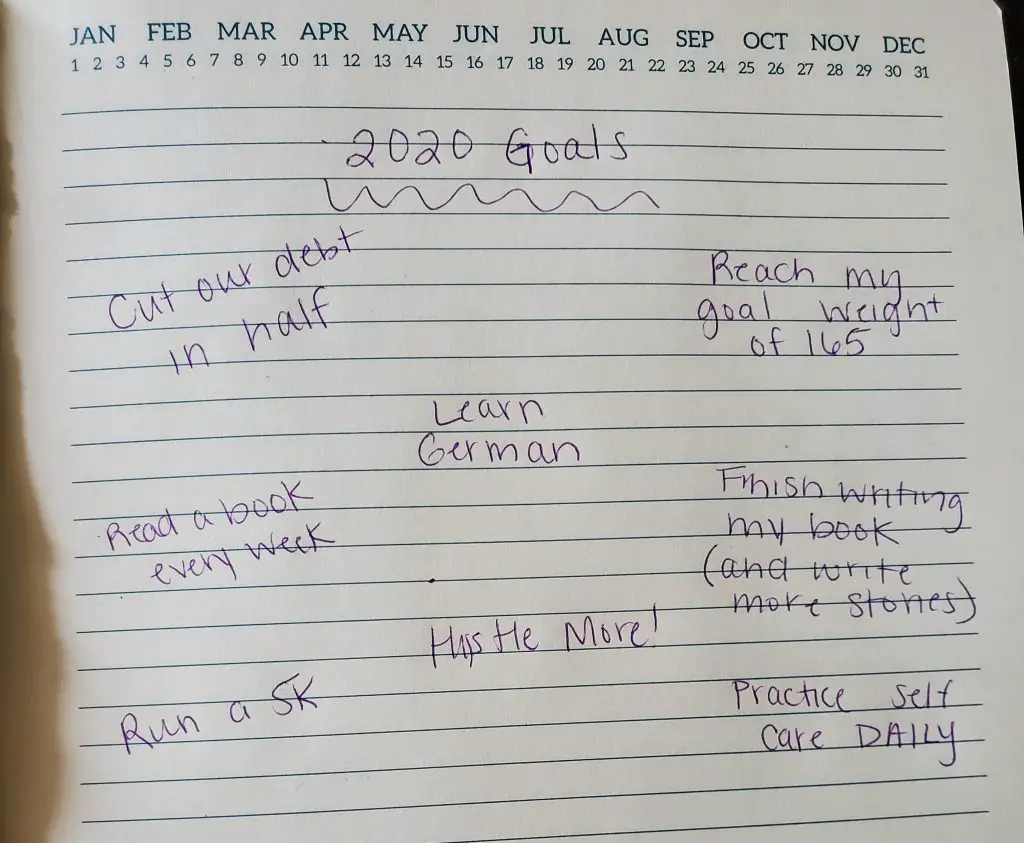

My New Year’s Resolutions

As you can see above, most of my resolutions have nothing to do with our finances (and that’s okay). Cutting our debt in half this year would be a HUGE deal for us and it is totally obtainable.

The other resolutions I’ve listed here are small but extremely important for me to maintain balance. First, my goal of “hustling more” will help us achieve our debt payoff goals. The more money we bring in this year, the more debts we can pay off. Next, self-care and health goals are always on my list. If you don’t invest in yourself (time or money), you won’t have anything to offer anyone else. This includes writing and reading more (for fun). Lastly, my husband and I have been slowly but surely learning German. I’d like to be fluent by the end of the year.

Unfortunately, most people stop trying to obtain their goals by the end of February (if they last that long). That’s usually because they’ve established these huge goals that are overwhelming, instead of breaking it down into smaller, easier tasks.

How to Create Reasonable Resolutions

So, how do you go about creating reasonable resolutions and goals for yourself? Well, first you should read up about SMART goal setting. This method of writing down and setting goals for yourself helps you create smaller tasks and organized your path to success. Here’s a quick breakdown of the process…

- Specific: Have a specific goal in mind. Instead of saying, “I’d like to be thinner by the end of the year,” say, “I’d like to reach 165 pounds by the end of the year.”

- Measurable: Be sure all of your goals are measurable in some way. As I mentioned above, we want to pay off half of our debt. This is measurable and specific.

- Achievable: This goes back to choosing goals that make sense for you to reach within a year (or whatever period of time you’ve set). Consider what is keeping you from that goal now and plan for changes you may need to make. Then assess whether or not it is actually achievable, making those changes as needed.

- Relevant: You always need to be sure the smaller goals you’re looking to reach make sense in the long-run. If you have a five-year plan, for instance, you should be sure you have goals this year to help you get there.

- Time-based: Once you decide on your goals, be sure you outline a timeframe in which you’d like to have it done. For example, to reach my end-of-year weight goal, I’ll need to lose X amount of pounds per month. Then check-in and see if you’re on track every three months, month, week, whatever works for you.

You should also realize that, sometimes, life gets in the way of things. Don’t be too hard on yourself! If you run into problems when you’re attempting to reach your goals, take a step back and assess whether or not you have been specific enough in naming what you want to achieve.

Leave a Reply