,

In total, Americans owe about $986 billion in credit card debt alone. For mortgages, the average borrower in the US has $236,443 in housing-related debt. Student loans also pack a punch, leaving the average borrower owing around $39,351. With so much debt piling up, many households are desperately trying to reduce their balances and eliminate their debt. If you want to conquer your credit cards, ditch your mortgage, free yourself from student loans, and otherwise remove creditors from your life, here is a look at the steps you can take to get out of debt.

Create a List of Your Debts

Before you take any steps beyond making your minimum payments, you need to understand your debts. Create a list that includes all of the lender names, debt types, interest rates, minimum monthly payments, and remaining balances.

As you compile the information, you should end up with a table that looks like this:

| Lender Name | Account Type | Interest Rate | Minimum Monthly Payment | Remaining Balance Owed |

| Bank of America | Auto Loan | 6.25% | $336.21 | $18,112.36 |

| Wells Fargo | Mortgage | 5.5% | $925.00 | $174,536.14 |

| Capital One | Credit Card | 17.9% | $181.40 | $7,256.18 |

| Best Buy | Store Credit Card | 25.9% | $64.67 | $2,586.88 |

| Sallie Mae | Student Loan | 6% | $168.16 | $23,472.01 |

| Credit Union | Personal Loan | 12.9% | $50.47 | $1,499.98 |

After gathering those details, you also want to total up your monthly payments to see how much you owe every month as well as your total balance owed. Using the example above, the total minimum monthly payments would be $1,725.91, and the total balance owed would be $227,463.55.

The idea is to get an incredibly clear picture of what companies you are paying, how much you are directing toward debt payments each month, and how much you owe.

If you are worried that you are overlooking a debt, head to AnnualCreditReport.com and request a free copy of your credit reports. The website is officially supported by the government, and you can get a copy of each of your reports from every major bureau every year at no cost. Then, you can review the reports for information about your creditors, including who you owe and other details.

Know Your Rights

If you have fallen behind on your debt payments, you might be stuck dealing with debt collectors. If so, it’s important to understand that all debt collectors have to follow certain laws.

Review the details of the Fair Debt Collection Practices Act if you want the most in-depth understanding of your rights and the various rules. If you want a solid overview using simplified language, the Federal Trade Commission’s Debt Collection FAQs is a good place to start. Along with information about what is and isn’t allowed, you can find out how to report a debt collector who violates the laws.

It’s important to note that individual states may have additional regulations regarding debt collection practices. In many cases, your state’s attorney general’s office can provide you with further details about your rights under your state’s laws. You can find contact information for your state attorneys general office through the USA.gov State Attorneys General search page.

Make Sure You Actually Owe on the Debts

There are instances where a person is subjected to billing or collection efforts even though the debt isn’t actually theirs. A company or debt collection agency might say that you need to pay when, legally, that isn’t the case.

At times, these attempts to get you to pay for a debt aren’t nefarious. In some cases, it is simply a mistake. A debt was associated with you on accident, such as through a technical error or an employee incorrectly entering customer information. If you believe one of the debts you are dealing with may fall in this category, contact the company or vendor. For additional support, you can also reach out to the Consumer Finance Protection Bureau, Better Business Bureau, or the Federal Trade Commission.

It is also possible that you have been the victim of identity theft. In these cases, someone else pretended to be you or used your personal information – such as your name, Social Security Number, and birthdate – to fraudulently open an account, making it appear that the debt is yours. If you might be the victim of identity theft, the Federal Trade Commission’s Identity Theft website can give you details about how to address the problem.

If a lender or debt collector says that you are responsible for a deceased loved one’s debt, they are usually incorrect. Debt can’t typically pass from one generation to the next if the surviving family member isn’t listed as an official borrower, such as by being a cosigner. Instead, any repayment is handled through the deceased’s estate. However, if you aren’t sure about your liability, you can consult a lawyer. Inheritance laws may vary from one state to the next, so it is wise to speak with a professional to confirm you aren’t responsible.

There are also situations where the debt was genuinely yours, but you are no longer obligated to pay it based on its age. There is a statute of limitations for many kinds of debt, and, once that period ends, the unpaid amount is time-barred. How long that time period is varies based on the type of debt and state law. If you aren’t sure if one of your debts is time-barred, contact your state attorney general’s office.

Understanding Your Interest Rates

Most people have heard debts being referred to as “high interest” or “low interest.” However, there isn’t usually a clear line that identifies what rates fall in which categories.

Since common repayment advice usually tells borrowers to focus on high-interest debts, it’s important to have some form of benchmark. One of the easiest ones is to compare the interest rate to what you could earn as a return if you invested the funds. If the interest rate is above the average return on an investment, consider it high-interest. If it is below, then consider it low-interest.

For example, the average S&P 500 return over the years has been about 10 percent. Using that example, all debts with a higher rate would be high interest. Any debts below 10 percent would be low interest.

Negotiating Principal and Interest Rates

Some borrowers are surprised that negotiating on debt principals and interest rates is an option. If you are struggling with your debt but have managed to stay current on your payments, you might have a decent credit score. If that is the case, you might be able to request a lower rate, reducing how fast interest builds up and potentially lowering your minimum payment.

If you do get any reductions in interest rates, update your debt list to reflect the new interest rates and minimum payments. Additionally, recalculate your total monthly payments and total amount owed, ensuring the information is current.

Additionally, if you can offer a substantial lump sum that is slightly below what you owe, the lender or debt collector might accept that amount as payment in full. Contact them, let them know what you can pay, and see if they will settle the debt for that amount. If so, get their commitment to closing everything out in writing before you send the payment. That way, you are protected if they try to avoid living up to their end of the bargain.

Just keep in mind that, if you settle the debt for less than you owe, there may be tax implications. You could receive a 1099-C (cancellation of debt tax notice) from the company. That means the difference between what you paid and what was owed might be considered income by the Internal Revenue Service (IRS), impacting your tax obligations. If you want to find out if the canceled debt is taxable, review IRS Topic No. 431 for additional information.

Create a Household Budget for Tackling Debt

Once you know who you owe and how much, have confirmed that you are responsible for the debts, and have negotiated when possible, you need to create a new household budget. Use your debt list as a starting point.

Next, add any more monthly expenses you have to handle. For example, this could include rent payments, utility bills, home or renter’s insurance, auto insurance, and any other recurring bills.

Then, put in details about your other living expenses that aren’t bills. For instance, groceries and fuel for your car would fall in this category.

The goal is to get a holistic view of where your money goes every month. If you spend money in one area on a monthly basis, write it down.

If your expenses exceed your income, then it’s time to make some cuts. See what costs you can reduce or eliminate. For example, eliminate cable television, reduce the number of streaming services you use, and pare down your food budget.

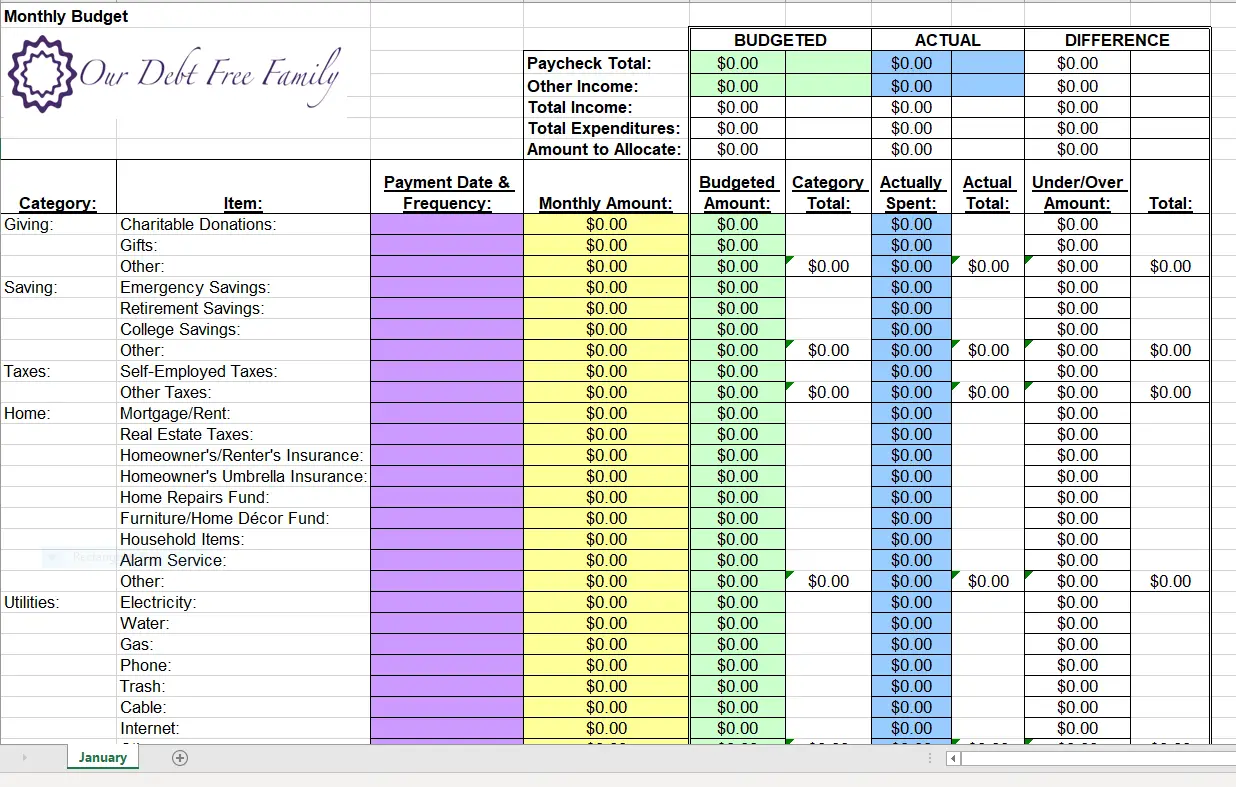

If you do not have a budget template, you can get one here. Here is a handy screenshot so you can see what a good budget looks like.

While you might have to live a bit uncomfortably for a while, this process will help you live within your means and pay off debt. Otherwise, you’ll need to find options for augmenting your income if you want to make serious headway.

Increasing Your Earnings to Defeat Debt

Whether you have a budget shortfall or simply want to tackle your debt as fast as possible, increasing your income is always a smart move. Begin by examining all of your household items and decide if there is anything you could sell or donate for a tax deduction.

After that, consider if you can enhance your earnings. Is getting a raise at your current job a possibility? Could you take on a second job? What about some freelance gigs? If increasing your income from work is possible, explore it.

Finally, you can also see if there is any assistance available that might allow you to pay off your debts faster. Check to see if you are eligible for government programs based on your income. Reach out to area non-profits, particularly if you might miss a rent, mortgage, or utility payment. While you might not find any options here, it is worth checking out if you are genuinely in dire straits.

Creating a Debt Payoff Strategy

Before you go beyond making your minimum debt payments, you need a payoff strategy. This will help keep you focused and prepare you to tackle your debt in the best manner possible.

There are two effective and popular strategies for paying off debt.

1) Debt Snowball. The Debt Snowball strategy was popularized by Dave Ramsey, a personal finance expert. In this approach, you focus on the debt with the smallest balance.

Essentially, you pay the minimum payment on every debt but the smallest. Next, you send every extra dollar you can toward the smaller debt. Once you tackle it, you get the mental boost of having a success. Then, you focus all of the money that was going to that debt to the new smallest debt, continuing the cycle until everything is paid off.

2) Debt Avalanche. The second option, the Debt Avalanche, concentrates on the highest interest rate debt first instead of the smallest. You make the minimum payment on every debt, only sending extra cash to the highest interest debt. Once that one is conquered, you focus on the new highest interest account. This approach is the best financially, as you’ll pay less in interest than if you use the Debt Snowball method in many cases. However, if your high-interest debts are large, you don’t get a mental win as quickly, which can be tough on your motivation.

Either approach is viable, as they both help you get out of debt. Consider if you need the mental boost of a quick win. If so, the Debt Snowball is for you. If not, then use the Debt Avalanche to save on interest.

Sometimes, it is easier to decide if you can see the difference. Luckily, you can find easy to use debt snowball and avalanche calculators that will do the math for you, allowing you to input information about your debts and see exactly how the results differ.

Keeping Yourself Motivated

Paying off your debt takes time. As a result, you need to find methods for keeping yourself motivated that don’t involve unnecessary spending.

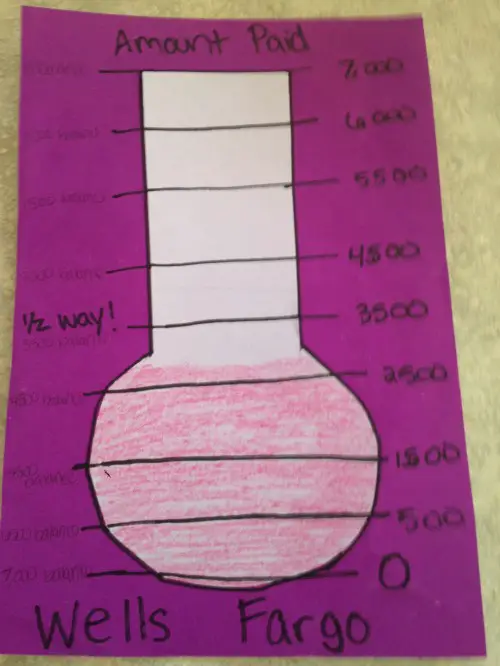

Many people enjoy having a visual aid. For example, you might create a debt thermometer that you can color in as you pay down your balances. This can help you see how far you’ve come, making it clear that progress is happening.

Additionally, updating your balance owed on your debt list to show the lower amounts can be encouraging. You get to put in smaller balances every month, an that can help keep you motivated.

Don’t Look for Shortcuts

While nearly everyone wishes that there was some kind of shortcut that can lead to debt elimination, there usually isn’t. It takes time, work, and dedication.

While there are reputable debt management organizations out there that can help make the process more manageable, there are also a ton of scams. Any company that touts their supposed ability to work a miracle and make your debt disappear should be considered highly suspect. If you are considering a formal debt management plan, research the organization heavily to make sure it is legitimate and doesn’t charge high fees that make your tough situation worse. If you have any doubts about their credibility, walk away, and get out of debt on your own.

Similarly, while many would suggest debt refinancing or consolidation, that isn’t always an ideal road. If you don’t have stellar credit, you might get a worse interest rate than you are dealing with today. Plus, it could potentially open the door for accumulating more debt, and that could make your situation worse.

This is especially true for balance transfer credit cards. Even if you could get a 0 percent rate for a period of months, using the service typically comes with a fee (around 3 percent of the amount transferred). Plus, if you miss a payment, you might lose the promotional rate, leaving you stuck with the regular (or even a penalty) rate instead. Unless you can be genuinely diligent and pay off the entire transferred amount before the promotional period ends, it usually isn’t worth pursuing.

Helpful Resources

There are plenty of helpful resources that can make your journey easier to manage. For example, online communities can give you moral support and might share tips that can help you get out of debt. Here are a few worth checking out:

There are also tons of Facebook groups dedicated to getting out of debt. You can perform a simple search and find people who are on the same debt conquering journey, which can be very beneficial.

Additionally, there are a bunch of personal finance experts that dole out helpful advice, including:

While you might not agree with everything they say or recommend, all of those experts can help you start thinking about personal finance in a new way.

Ultimately, it is possible to get out of debt. While it does take time and diligence, it is a journey worth taking. Assess where you are, figure out where you want to be, and create a strategy that will let you get from point A to point B over time. In the end, you’ll be happy that you started on the journey and elated once you are done.

Leave a Reply