Mom Pays Son’s Debt: Should You Consider Paying Your Child’s Debt?

When faced with the reality of your child struggling with debt, many parents feel the urge to step in and help. But is paying off your child’s debt the right move? While it can provide immediate relief for your child, it’s important to weigh the long-term benefits and drawbacks of this decision. Here’s a look at both sides, including some 2024 financial debt trends and the potential dangers your child may face if they’re overwhelmed by debt.

Benefits of Paying Your Child’s Debt

- Immediate Relief from Financial Strain One of the most obvious benefits of paying off your child’s debt is the immediate relief it provides. Financial stress can take a toll on your child’s well-being, causing anxiety and affecting their ability to manage their day-to-day responsibilities. By offering financial help, you give your child space to focus on improving their situation without the constant pressure of debt.

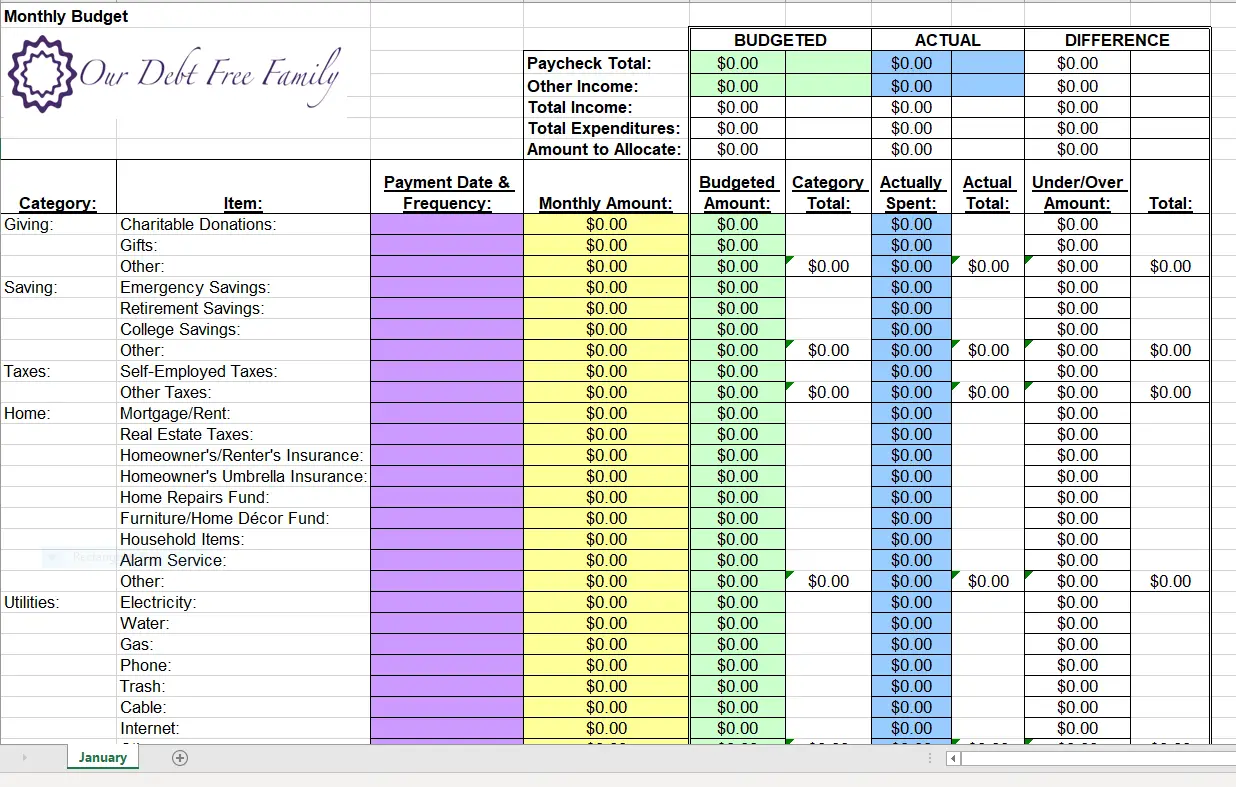

- Teaching Financial Responsibility Paying your child’s debt can be a valuable teaching opportunity. When done thoughtfully, you can use this moment to help your child better understand financial responsibility. Set clear expectations for budgeting and managing money in the future, ensuring they avoid repeating the same mistakes that led to debt.

- Protecting Your Child’s Credit Score If your child is struggling with overdue bills or high-interest payments, their credit score can suffer. In 2024, credit reports are increasingly being used not only for loans but also for rental applications and even job prospects. Protecting your child’s credit score by helping with debt can ensure they have a better chance at future financial opportunities.

- Strengthening Family Bonds Offering financial support can reinforce family financial support and show your child that they can count on you during tough times. This can strengthen your relationship and foster open communication about money, creating a healthier dynamic when it comes to discussing finances.

Drawbacks of Paying Your Child’s Debt

- Risk of Enabling Poor Financial Habits While paying off your child’s debt may provide temporary relief, it could also reinforce poor financial habits. If your child knows that they can rely on you to bail them out, they may continue to make irresponsible financial decisions. This can lead to a cycle where they fail to learn financial lessons and continue to rely on you for help.

- Strain on Your Own Finances Paying off debt, especially if it’s significant, can place a strain on your own finances. It’s essential to consider whether you can afford to help without sacrificing your own financial security. Family money matters, and jeopardizing your own financial well-being could affect your future stability and retirement plans.

- Missed Opportunity for Growth Struggling with debt can be a powerful learning experience. Your child may need to go through the process of debt repayment on their own to fully grasp the consequences of their actions. Bailing them out may rob them of the chance to develop resilience, responsibility, and problem-solving skills.

- Creating Dependency Offering too much financial help can lead to a sense of dependency, where your child may expect you to step in every time they face a financial challenge. It’s important to find a balance between helping and encouraging your child to take ownership of their financial responsibilities.

2024 Debt and Credit Statistics for Young Adults

In 2024, young adults in their 20s and 30s are carrying a significant amount of debt, primarily due to student loans and credit cards. According to recent statistics:

- The average credit card debt for young adults under 30 is approximately $4,200.

- Around 1 in 5 young adults have a credit score below 600, classifying them as subprime borrowers.

- The total student loan debt in the U.S. has exceeded $1.8 trillion, with the average borrower owing nearly $37,000.

With inflation and rising living costs, many young adults are resorting to credit cards to cover basic expenses, which only increases their financial burden. These numbers highlight the significant challenges young adults face when trying to manage their debt, which can put them in dangerous financial situations if left unchecked.

Extreme and Dangerous Measures to Pay Off Debt

For some young adults, overwhelming debt leads to extreme actions. Here are some risky behaviors that could result from a desperate attempt to eliminate debt:

- Taking High-Interest Payday Loans

In an effort to pay off credit card debt or student loans, some young adults resort to payday loans. These loans often come with interest rates exceeding 400%, trapping borrowers in a vicious cycle of debt that’s nearly impossible to escape. - Participating in Risky Investments

Desperate to make quick money, some young adults turn to speculative investments, such as cryptocurrency or day trading. While these strategies promise quick returns, they can also lead to significant losses, further worsening their financial situation. - Selling Personal Belongings

Another extreme measure includes selling valuable possessions, such as electronics, jewelry, or even cars, to pay off debt. While this may provide short-term relief, it can negatively impact their quality of life and create additional stress. - Undertaking Multiple Jobs or Gig Work

In a bid to make extra cash, many young adults take on multiple jobs or participate in gig economy work. While this can help them manage debt, the long hours and physical toll can lead to burnout, affecting their mental and physical health. - Risky Personal Loans from Friends or Family

Some may seek personal loans from friends or family members, risking relationships if they’re unable to repay. This can create long-lasting tension within families, and borrowing money can sometimes become a pattern of dependency.

Finding a Middle Ground

If you’re on the fence about whether to pay off your child’s debt, consider alternatives that offer support without full financial rescue:

- Debt Repayment Advice: Guide your child through creating a budget or negotiating with creditors. This way, you offer support without paying their debt directly.

- Set Conditions: If you decide to help financially, set clear conditions. For example, you could require that they take a financial education course or stick to a strict budget.

- Help in Smaller Ways: Instead of paying the entire debt, consider offering a partial payment or assisting with a specific debt, such as a high-interest loan.

Conclusion

Deciding whether to pay your child’s debt is a deeply personal choice that depends on your financial situation, your child’s habits, and your family dynamics. While parental financial help can offer immediate benefits, it’s essential to consider the long-term impact on both your finances and your child’s financial independence. Striking the right balance between supporting your child and fostering their financial responsibility is key to helping them succeed in the future.