Last week, I chatted about money challenges and how they can help you reach your financial goals. In the blog post, I mentioned that many people “hack” the challenge and switch it up to focus on paying off debt instead, making it a debt payoff challenge.

Well, the folks at Credit Karma have gotten together to put together a challenge. However, instead of spreading it out over the span of the year, it challenges you to lose the debt in 30 days. Here’s how…

The 30-Day Debt Payoff Challenge

Paying off debt, even a small amount, can significantly improve your financial outlook. Like a 30-day weight loss challenge, a 30-day debt payoff challenge focuses on trimming the amount of debt you carry little by little with these steps.

- Cancel all of your unused subscriptions. You’d be surprised at how much money you’re wasting month to month. Whatever you’re able to save, apply it to your debt!

- Cook at home and use what you have. Eating out is expensive, even if you’re single. Cooking at home saves us around $400 per month (seriously). Also, try using what you have in your house and go as long as you can without shopping. You can use this app to find recipes using ingredients you have in the house.

- Skip your morning coffee and drink more water. Starbucks coffee every day is expensive and water is free, it is as simple as that.

- Make lists when you shop and buy generic. When you go to the store, go with a strict list and do not stray from it. You should also try to buy generic brands when possible.

- Plan a no-spend weekend. Pick at least one weekend a month where you just stay home! You can check a few things off your to-do list around the house and save money.

- Turn off the lights and unplug appliances. You can also save by closely monitoring your water and gas usage. Then, put the extra cash towards debt payments.

- Consider swapping your car for ride-sharing. In some cases, it may be cheaper for you to sell your car and use Uber or Lyft. If your daily ride-sharing bill will be less than your car payment, insurance, gas, and parking, it may be something to consider.

- Look for free things to do. There is something free to do, always. Check out your local library, head to the park, and scope out local bulletins for events.

- Enroll in automatic savings at your bank. Always pay yourself first. You can set up automatic transfers to savings when you get paid.

- Pay in cash (you may be able to save). At some businesses, you can save money if you pay in cash instead of check or card. This is the case at most gas stations.

- Call and negotiate the rates. Take a look at your bills and see if there are any fees you can get waived or interest rates you can negotiate. Then, give the creditor or company a call.

- Be thrifty. Instead of getting new clothes at the department store, head to the thrift shop. You’ll be surprised at what you’ll find and how much you’ll save.

- Host a yard sale. When you have gone through your closets, host a virtual or physical yard sale. YOu can set them up and promote them via social media.

- Make more payments with the money you’ve made/saved. Once you start seeing “extra” money, put it towards your debt repayment.

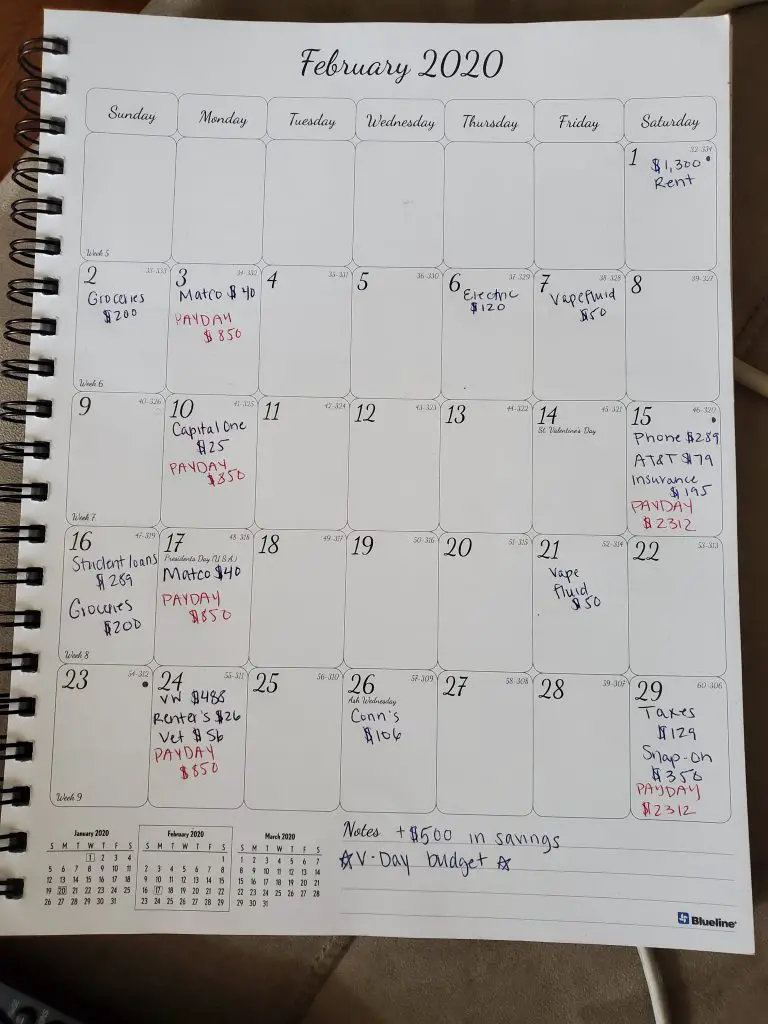

- Compare month-to-month. At the end of the month, compare your finances to the previous 30 days. What has changed? Are there habits you’d like to keep?

Credit Karma outlines all of this across 30 days (you can see the original post here), but I’ve condensed it a bit. Instead of focusing on one new habit every day, you focus on one habit every two days over the span of the month.

Altering the Challenge for Your Needs

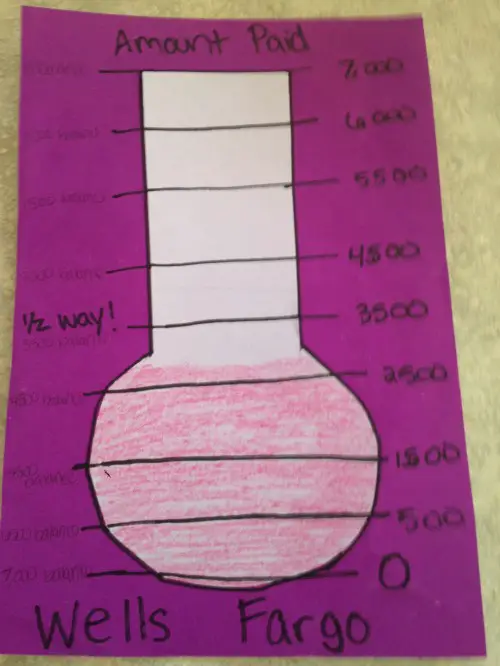

Of course, everyone’s financial situation is different. If you need to make more aggressive payoff attempts, you may want to consider a more strict snowball method. If you want to snowball a challenge, you can do that too.

To alter the challenge, you would try to increase the amount you are able to snowball towards your debt each week or month. For instance, you may want to increase your snowball amount by $1 the first week, $2 the second week, $3 the third, and so on.

Others may find it better to increase the total monthly amount like $100 the first month, $200 the second month, $300 the third month, and so on. As you pay things off, the more “extra” money you’ll have to toss at other debts, making it easier to increase the amount you’re paying.

Either way, committing to the challenge and making the changes you need to in your life to pay off your debt can be life-changing. A plethora of individuals on the web have saved and paid off debt thanks to these challenges.

Readers, have you tried a debt payoff challenge? What were the results?