Breaking Free After 50: 10 Credit Card Debt Solutions Every Boomer Should Know

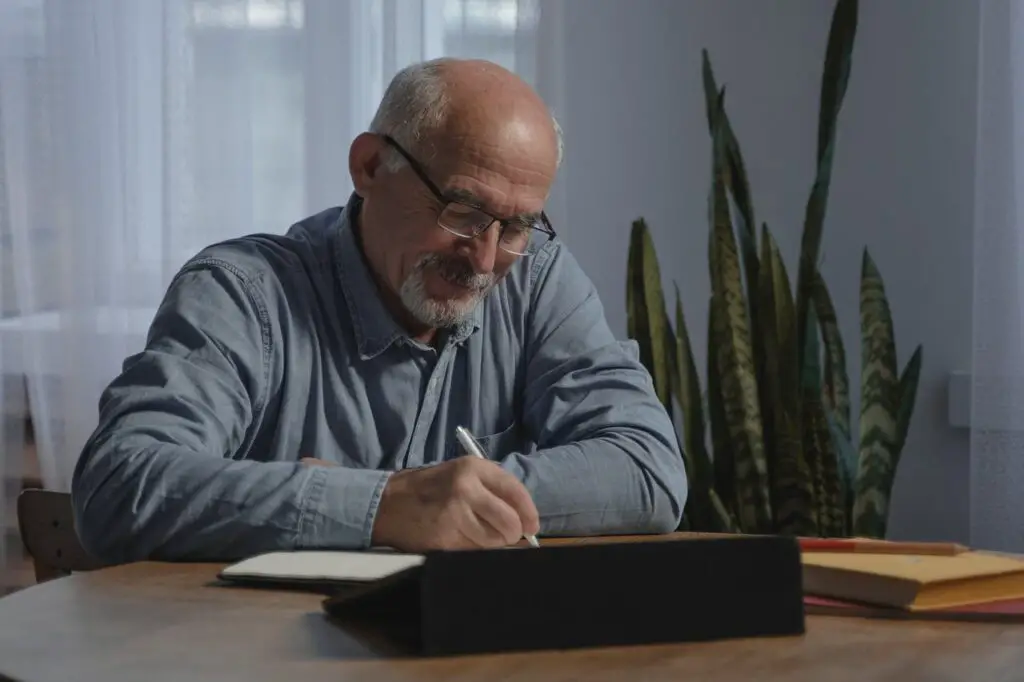

Picture this: you finally reach a point in life where you should be enjoying more freedom, traveling when you want, maybe spoiling the grandkids, and just breathing a little easier. But instead of feeling liberated, you find yourself weighed down by credit card debt that keeps hanging around like an uninvited guest at the family barbecue. If that sounds familiar, you are not alone.

Millions of baby boomers across the United States are still juggling credit card balances even as they try to transition into retirement or live on a fixed income. The good news? You do not have to let credit card debt define this chapter of your life. There are practical, realistic, and surprisingly effective ways to take control of your finances and finally give yourself some breathing room.

Below are 10 credit card debt solutions every boomer should know. Some of these steps will help you save money, others will help you organize your payments, and a few may simply offer peace of mind. Pick the ones that fit your situation best and remember: progress is progress, no matter how small.

1. Make the Call: Negotiate Directly with Your Creditors

One of the most powerful steps you can take is also one of the simplest—picking up the phone. Many credit card companies are open to negotiating interest rates, adjusting payment plans, or offering temporary hardship programs if you explain your circumstances. Whether your challenge comes from medical expenses, reduced hours at work, or unexpected bills, being proactive can save you money. Always ask for written confirmation of any agreement so you are not left with unpleasant surprises down the road.

2. Snowball or Avalanche: Choose the Repayment Style That Works for You

There are two tried-and-true debt repayment strategies: the snowball method and the avalanche method. The snowball method focuses on paying off your smallest balance first, which gives you quick wins and keeps motivation high. The avalanche method, on the other hand, targets the balance with the highest interest rate first, saving you more money in the long run. Neither option is right or wrong—it depends on whether you are motivated by momentum or by maximizing savings. The important part is committing to whichever method feels most realistic for you.

3. Simplify with Debt Consolidation

If you are juggling multiple credit cards, debt consolidation can be a lifesaver. By rolling your balances into one loan or transferring them to a card with a lower interest rate, you reduce the hassle of managing multiple due dates. This strategy often helps cut interest costs too. Just be careful to read the fine print on fees, introductory rates, and repayment terms. Debt consolidation works best when paired with discipline—otherwise, you could end up right back where you started.

4. Enroll in a Debt Management Plan

Debt management plans, often set up through nonprofit credit counseling agencies, allow you to combine several debts into one manageable monthly payment. These agencies negotiate with your creditors to reduce interest rates and eliminate some fees. It is not magic, but it can feel close to it when you see your balances shrinking faster than they were before. Be sure to work with a reputable nonprofit agency so you do not fall into the trap of scams.

5. Consider Debt Settlement Carefully

Debt settlement should always be a last resort, but in some cases, it may be an option worth exploring. This involves negotiating with creditors to pay less than what you actually owe, usually in a lump sum. While this can reduce your debt, it often comes with serious consequences such as a damaged credit score and potential tax obligations on the forgiven debt. If you consider this route, make sure you consult with a trustworthy attorney or financial advisor first.

6. Use Home Equity With Caution

For homeowners, tapping into home equity through refinancing, a home equity loan, or even a reverse mortgage may seem like a tempting way to wipe out credit card debt. While this can reduce high interest balances, it also ties your home to your debt. If your income changes or unexpected expenses arise, you risk putting your house at risk. Think of this option as a tool to be used carefully, only when you are confident in your ability to manage the repayment.

7. Trim Expenses and Reclaim Your Budget

Sometimes the simplest approach makes the biggest difference. Go through your budget line by line and look for places to cut back. Maybe you are paying for subscriptions you no longer use, dining out more often than you realized, or letting small purchases add up. Redirecting even a few extra dollars a month toward your debt can add up quickly. Plus, once one card is paid off, you can use that freed-up payment to tackle the next one, creating a snowball effect of your own.

8. Bring in Extra Income or Use Windfalls Wisely

If you are able, consider picking up a part-time job, consulting, freelancing, or even turning a hobby into income. Many boomers find joy in side gigs that are flexible and enjoyable, and the extra money can make a real dent in credit card debt. Additionally, use windfalls like tax refunds, bonuses, or inheritances to pay down balances instead of splurging. Treat these one-time boosts as opportunities to accelerate your journey to financial freedom.

9. Explore Hardship Programs or Temporary Forbearance

Life happens, and sometimes you just need a pause. Some credit card issuers offer hardship programs that temporarily lower or suspend payments if you are experiencing financial difficulty. These programs can provide breathing room while you regroup and get back on your feet. The key is to contact your creditor early—before you miss payments—so you can protect your credit score and avoid late fees.

10. Bankruptcy: The Reset Button, but Use with Care

No one wants to think about bankruptcy, but in certain cases, it may be the best path forward. Filing for Chapter 7 or Chapter 13 bankruptcy can help eliminate or restructure debt, giving you a chance to start over. Of course, the consequences are serious: damaged credit, difficulty accessing new credit, and a public record of the filing. Bankruptcy should always be considered a last resort, and only after you have explored other options. If you find yourself at this point, consult a trusted bankruptcy attorney to understand your choices fully.

Final Thoughts

As a boomer, you have already weathered countless challenges—raising families, building careers, navigating life’s curveballs. Tackling credit card debt is just one more challenge, and it is one you can absolutely overcome. The key is to stay proactive, consistent, and willing to seek help when needed.

Imagine the peace of mind that comes with fewer bills, fewer worries, and more control over your money. That is not just a dream—it is a future within your reach. You have worked hard to get here, and you deserve to enjoy these years without the shadow of credit card debt. Take the first step today, keep at it tomorrow, and watch how quickly freedom begins to feel possible again.