Have you ever looked back at an investment or a business decision and realized it was driven by emotion, rather than strategy? This is far more common than most entrepreneurs would care to admit. [Read more…]

Frugal Date Ideas for All Year Long

Taking time to spend with your significant other is always a good investment. In our home, we have at least one night per week that cell phones are put down and we just spend time together. It is necessary to maintain our relationship. Sometimes, we like to incorporate some fun date nights too. There are people who might use something like True Pheromones to make themselves extra-appealing to their partner if they want to put them in the mood for an intimate evening in together. However, going out for a date can get pretty expensive, depending on what your plans are. Here are some frugal date ideas that we love.

Frugal Date Night In

My husband and I are both fans of the “date night in,” especially in the post-pandemic world. Some of our favorite things to do at our home cost next to nothing too. Consider adding some of these activities to your plans!

- Check out your streaming services. If you are like us, you don’t get a chance to watch all of the shows and streaming services we’d like to. Take a moment to check out what you’re subscribed to and make a list for your date night. Curl up with your favorite snacks and settle in for the night. (This is probably our favorite of the frugal date ideas.)

- Take advantage of a free trial. If there is a movie you’ve been wanting to see or a show you’ve been wanting to binge-watch, take advantage of a free trial on date night. You can start the show or watch the movie free of charge. Just don’t forget to cancel your subscription before you get charged!

- Play a game of cards or break out the board games. Every once in a while we will pull out a deck of cards and play a few games of Rummy. We also have a few board games we take out of the closet occasionally. These are great, fun ways to spend date night at no cost.

- Try out Playstation Plus. This service gives you access to a wide variety of different video games. You can try out some new games you’ve never played and have a great time. They offer a free trial and then after that it is $9.95 per month. If you’re both avid gamers, it can be a great cheap date night every month.

- Make homemade pizza or pick a recipe to try. Cooking in will always be cheaper than ordering food or eating out.

- Learn something together. We like to seek out documentaries about new things, YouTube videos, and other informational materials and learn new things together. It can give you something new to talk about and is an extremely frugal date night.

- Get physical. You can get a wide range of workout videos on YouTube. Pull up a yoga class or cardio class to do together.

Other Frugal Date Ideas

Of course, you don’t have to stay in to stick to your budget when it comes to going on a date. There are plenty of frugal date ideas outside the home as well. When the weather is nice, we enjoy some of these on a regular basis.

- Head to the park.

- Go on a hike.

- Rent bicycles or roller skates.

- Pack a picnic and take a drive.

- Find a drive-in movie theater.

- Plant flowers or work in a garden.

- Search for coupons or deals for local restaurants.

These are just a few of our favorite go-to date ideas, but there are plenty of ways to spend time with your significant other without breaking the bank. Think about what your partner might enjoy doing and find a few frugal dates you’ll love. Readers, do you have any frugal date ideas to add? Leave yours in the comments!

Read More

How to Create an Aggressive Savings Plan

Our family is attempting to save more money in the coming months with some big changes on the horizon. When we started trying to plan for this, we started throwing around some pretty big numbers. However, I know from previous experience these lofty numbers are difficult to reach and focus on. So, how do you create an aggressive savings plan?

How to Create an Aggressive Savings Plan

First and foremost, before you start planning out the perfect savings plan for you and your family, you should research some of the best high-yield savings accounts. These will give you more bang for your buck in terms of interest rates. Once you find a savings account that you want to use, then you can begin crafting the ultimate savings plan.

Set a Specific Savings Goal

You need to have a specific number in mind when you are setting a savings goal. Decide why, or what, you are saving for and focus on that. For example, you want to save $10,000 by the end of the year in preparation for a new baby. This gives a why, an amount, and a period of time in which to meet the goal. Your savings goal may be smaller. For instance, you may need to save $1,000 for an emergency fund by the end of next month. Whatever the goal is, it needs to be specific.

Really Examine Your Finances

When I say really examine your finances, I mean with a fine-tooth comb. You need to know how much money is coming in, what’s going out, and be able to identify unnecessary expenses. When we took a closer look at what we were spending we realized we overspent on our grocery budget every single month. Why? We eat out too much. It is pretty simple, but when you see the numbers behind it (in our cases hundreds of dollars), it can inspire change. That money really starts adding up once you start stacking it in your savings account.

Stop Spending and Find Ways to Grow

When you examine your finances, you’ll likely find things you didn’t know you were wasting money on. Determine where your costs can be decreased and trim those expenses. For instance, if you are trying to save $10,000 by the end of the year, skipping your bi-weekly manicure will probably help you get there.

In addition to finding areas in your budget to trim, you should also find new ways to bring in money as well. Look for a side hustle or part-time job to amp up your savings even more. Or consider some basic hacks, such as using rebate sites when you shop, making use of coupons, or possibly scanning your receipts for some extra savings.

While saving money may be a top priority for you right now, that doesn’t mean you should cut all of the fun out of your budget. In fact, cutting everything out of your budget is a bad idea and can lead to abandoning your savings plan altogether. Instead, incorporate rewards for meeting goals and milestones into your budget. You should also keep one or two fun things in there as well.

What Makes a Savings Plan Aggressive?

Now, you may be thinking this doesn’t sound very different from any other savings plan, but what makes your plan aggressive is the amount of time and effort you are willing to put in. You may want to save $10,000 in the fastest amount of time possible. To do this, you may decrease your spending, pay down debts and reallocate the funds to savings, and look for additional work to increase your income.

All in all, an aggressive savings plan is all about how aggressive you make it. Some individuals will move out of their home, rent a room, and slum it for a few months to completely overhaul their finances. Other people, myself included, want to find a more comfortable way to master saving.

Be Patient With Your Progress

No matter where you are in your financial journey, patience is key. I have learned throughout my own debt freedom journey and my relationship with finance that when you run out of patience, you also run out of the drive to make your goals happen.

One thing you should always strive to do throughout your own personal journey is learning from your mistakes. When something doesn’t go as planned or things fall through the cracks, really think about why it happened and what you can do to improve. You may not get it on the first, second, or even third try, but not giving up is the important part.

Readers, have you ever created an aggressive savings plan? How much did you save? How much time did it take?

Read More

Debt Blogs to Follow for Inspiration

Finding inspiration on your debt free journey can be a struggle sometimes, especially if you’re feeling like you’ve run out of ideas. Inspirational quotes can only go so far. That being said, there are plenty of inspirational debt blogs to follow if you need a good debt freedom story or piece of advice.

Debt Blogs to Follow When You Need to Be Inspired

When I started my debt-free journey, I was lucky enough to have this platform to look back at some really inspirational debt stories. That made me want to go searching for more. These are just a few great debt blogs I’ve been following.

Club Thrifty

Club Thrifty is another great debt blog to follow. The blog’s motto “Stop Spending. Start Living.” is really all you need to know! If you want to become (and stay) debt free, more than likely you’ll have to be a little thrifty and this is a great place to find inspiration.

Dear Debt

You may have read my suicide prevention post last year. Dear Debt’s Melanie sponsors those suicide prevention blogs each year. She’s paid off $81,000 in debt and has continued to help others reach their goals through public speaking and her blog.

JackieBeck.com

Jackie Beck and her husband paid off $187,000 in debt, including their mortgage. On top of having a blog helping others become debt free, Jackie has also launched her own app and has a number of helpful finance tools.

My Debt Epiphany

My Debt Epiphany focuses on gaining financial freedom. Started by Chonce, a certified personal finance coach, the blog has a number of resources available. Not to mention, it also provides insights into Chonce’s debt payoff progress and things she’s doing to gain her financial freedom.

Debt-Free Podcasts to Give a Listen

Podcasts have become more trendy as well. In fact, I find myself listening to The Dave Ramsey Show while I’m writing all the time (which is mentioned below). However, there are plenty of other great debt podcasts to listen to if you’re not a huge fan of Ramsey’s tactics.

Chain of Wealth

I was featured on Chain of Wealth towards the end of the year last year. This podcast has some really great episodes!

Follow Me Out of Debt

Follow Me Out Of Debt podcast is an easy-to-understand conversation. It comes out once a week and follows the advice of well-known influencers, such as Dave Ramsey and Suze Orman. Tom, the podcast host, lets listeners know which strategies have worked the best for him in his debt freedom journey.

Frugal Friends Podcast

As mentioned a few times on this blog post, and many other posts on Our Debt Free Family, frugality and debt freedom often go hand-in-hand. Jen, one of the podcast’s hosts, paid off $78,000 in debt. Her co-host, Jill, loves to scout out great deals and lives for being frugal. It is a great thing to give a listen if you’re looking for ways to cut spending and maintain motivation on your debt free journey.

Know Debt, No Problem with Mary A. Wheeler

Mary Wheeler delves into tackling student loan debt and moving forward financially. She offers real-life stories and situations that have led her to where she is now (debt free and loving it).

The Dave Ramsey Show

Last, but certainly not least, The Dave Ramsey Show. You can catch Dave’s on YouTube, iTunes, and just about any other streaming source. While his approach can be a little rough and to-the-point, he has helped thousands of people get out of debt and obtain financial freedom with his advice.

These are just a few of the debt blogs and podcasts I follow. Have one to add to the list? Comment below!

Read More

My Favorite Debt-Free Instagrammers

Instagram is a great place to find other people in the debt-free community. Many Instagrammers share debt updates, budgets, saving tips, and real-life experiences in their own debt freedom journey. Here are five of my favorite debt-free Instagrammers.

My Top Five Debt-Free Instagrammers

There are so many fabulous and inspiring debt-free families, couples, and individuals over on Instagram. If you haven’t already signed up for Insta, do it! Then check out these five accounts…

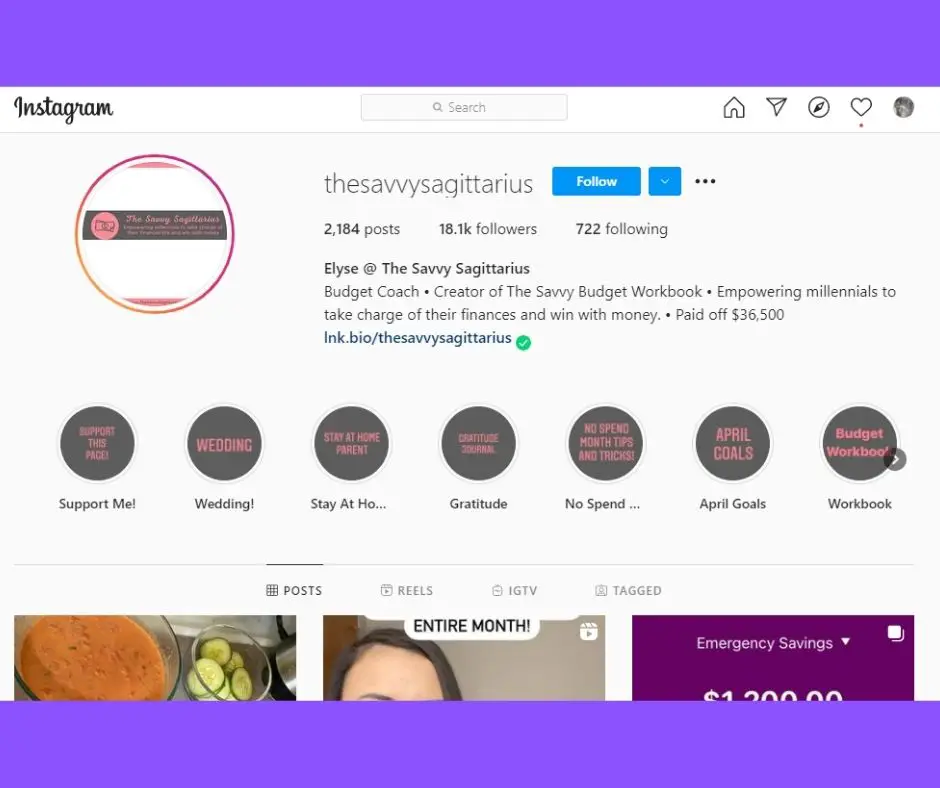

1. The Savvy Sagittarius

Elyse, also known as The Savvy Sagittarius on Instagram, has paid off $36,500 in debt. Over the time she paid off her debt, she’s documented her journey on Instagram. She also now provides helpful tips to others getting started and keeps everyone updated on her current financial success. Elyse often performs challenges, such as No Spend September, and she updates her audience on her savings goals. This is a great Instagram page to follow if you’re looking for someone who is financially focused.

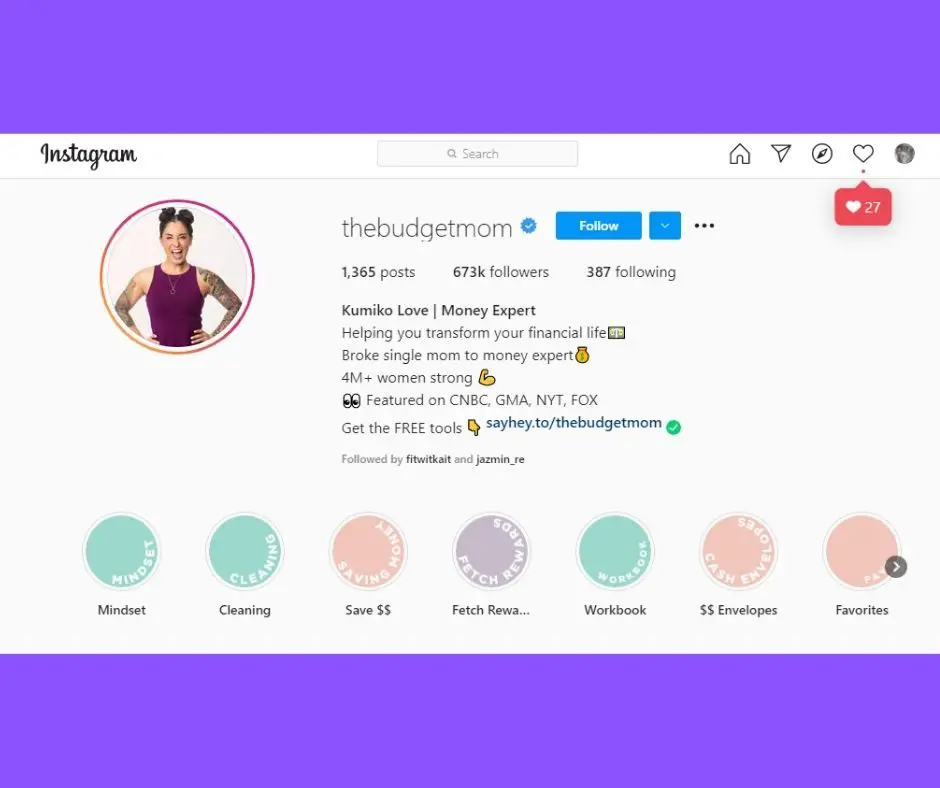

2. The Budget Mom

The next on my list of debt-free Instagrammers is Kumiko Love or The Budget Mom. Kumiko started out as a broke, single mom and has seriously transformed her life. She has gained financial and debt freedom. Now, she shares her experience and knowledge with others. Best of all, she posts a lot of free tools and templates to help you get started with budgeting, saving, and paying off debt.

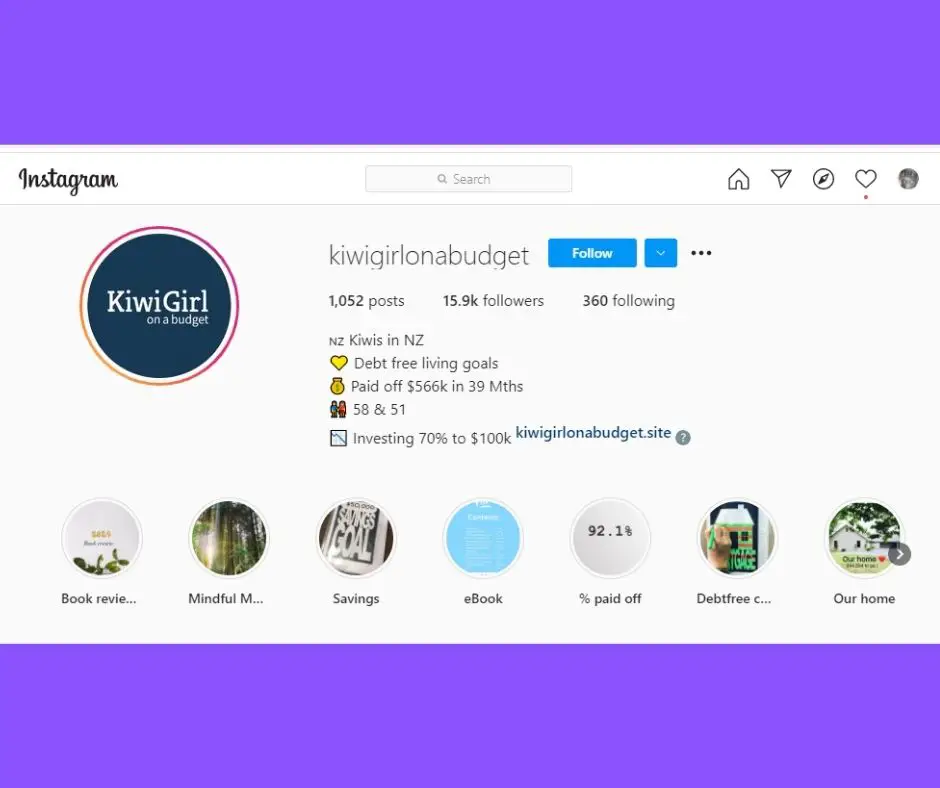

3. Kiwi Girl on a Budget

This Instagrammer is possibly one of my absolute favorites! They paid off an astounding $556,000 in debt in 39 months. How amazing is that?! Now, the main focus of the couple as they move forward in their financial journey is investing money for the future. They are investing 70% to $100K. The page itself offers up some good tips and inspirational posts to help motivate you on your own financial journey.

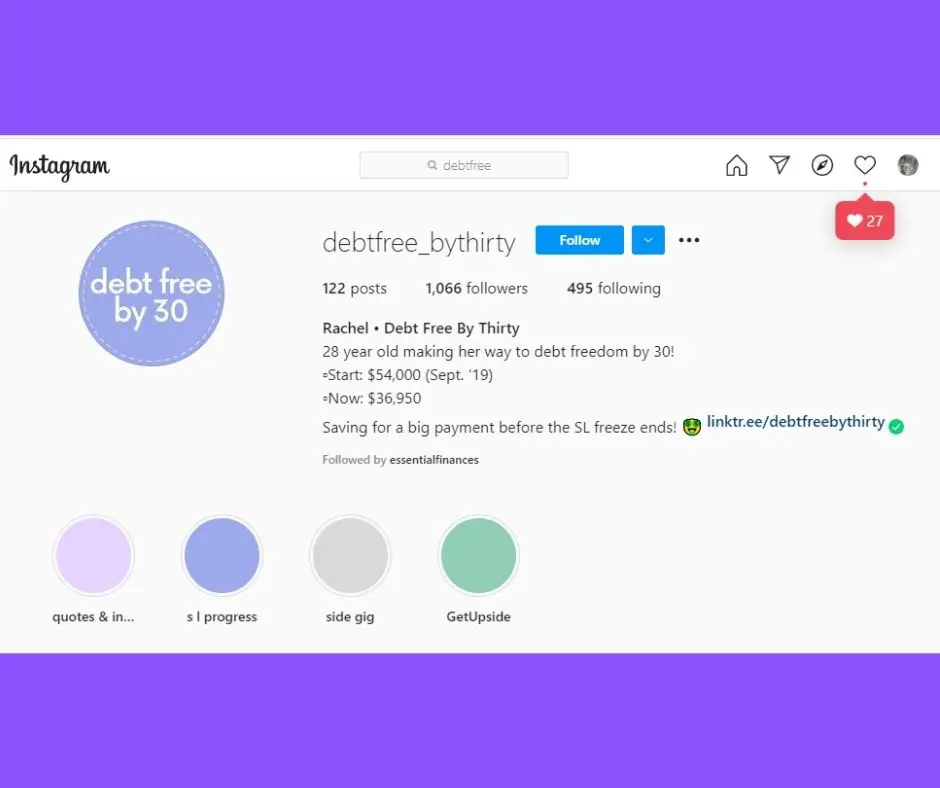

4. Debt Free By Thirty

I think I enjoy following this page so much because the creators are closer to my age. As you can probably tell by her name, the goal is to be debt-free by the time she turns 30. I will be 30 myself in less than two years. So, the story here is pretty inspiring to me personally and you may find it to be too! Rachel has already paid down a significant amount of debt. She started with $54,000 in September 2019 and now only holds $36,950 in debt. She shares regular progress updates and tips as she goes, which are helpful too.

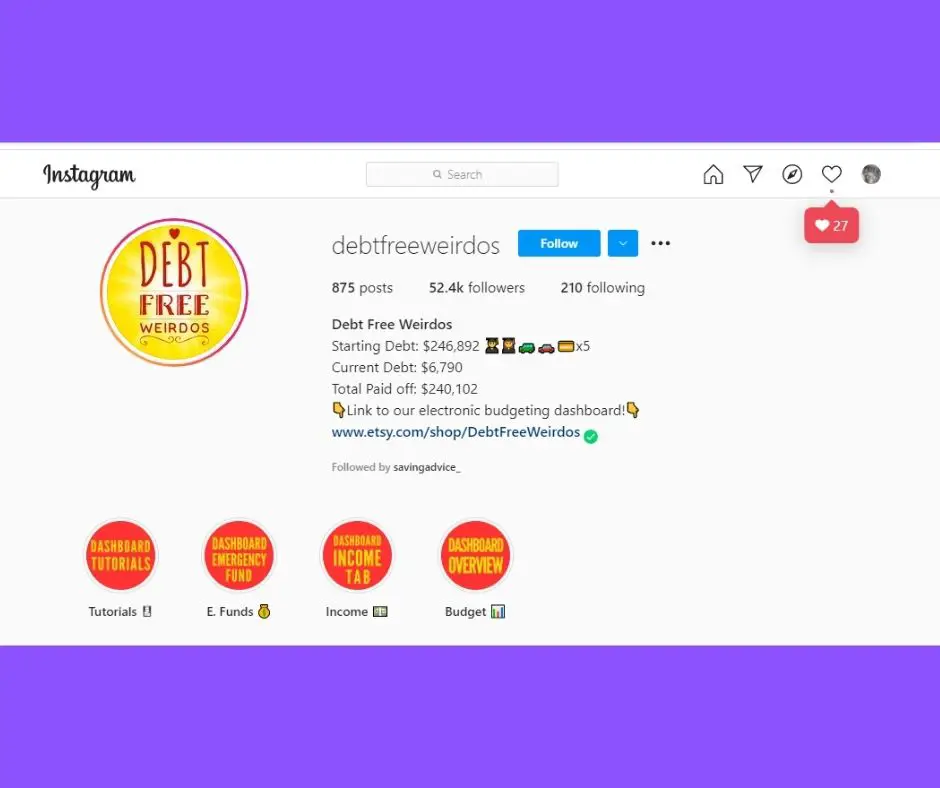

5. Debt Free Weirdos

I was originally drawn to this page because of the quirky name. Isn’t everyone in the debt-free community a little weird? What kept me sticking around was their amazing story. They’ve paid off more than $240,000 in debt! They have less than $7,000 to pay off and are just killing it. As of September 24, 2021, they will be completely debt-free. They’ve talked a lot about how they will celebrate and I can’t wait for them to reach that goal. It is truly inspirational.

These are just a few debt-free Instagrammers out there. Do you have any Instagram accounts you love to follow? Drop them below!

Read More

How We Are Preparing For Our New Arrival

If you have ever prepared for the arrival of a new baby in the age of the internet you know there is a plethora of information out there. Sometimes it seems like too much. Do I have all the items deemed necessary by blogger moms for delivery? Will I have everything I need for recovery? Should I write out a detailed birth plan? Honestly, it can be overwhelming. That’s why we decided to dial down the use of the internet and focus on we can best prep for the arrival of our baby girl.

Preparing for Our New Arrival

My mom has told me about a dozen times that she didn’t need much in terms of creature comforts when she went into labor with me. “You don’t need that much, don’t overdo it.” While I trust my mom’s judgment and value her input, you could also smoke cigarettes in the hospital when I was born. It has been a while since she’s gone through pregnancy, labor, delivery, and postpartum recovery. She will undoubtedly be a rock of support for me but when it comes to how to best prepare, we’ve done our research to figure out what will work for us.

We got our hospital bags packed this week. Baby Blankenship is due September 2. Hopefully, she will at least be on time (if not a little early). I’ve done so much reading when it comes to prepping for our little one. What foods should I eat for breastfeeding, hospital bag must-haves, and even how to best introduce our beloved family dog to the new member of the family. More recently, I’ve been researching what to expect during labor, things we should have with us (and things that are provided), and have been attempting to be as prepared as humanly possible.

My husband realized it was stressing me out a bit. After all, the internet is literally full of information and every mom thinks she got it right when it comes to how she prepped for the birth of her child. That’s the thing though. It is a very personal experience and you should cater it to your personal preferences.

For instance, many moms said they packed makeup for their delivery so that they could look nice in photos. I read this and thought to myself, “Seriously?” There’s no way I’m going through the trouble of putting on makeup when I just birthed a baby. However, I do think it will be worth it to pack a comfortable blanket, robe, and comfort items from home. We also hit Costco and stocked up on some snacks, which will come in handy, especially if I give birth at an odd hour of the night. The hospital cafeteria doesn’t open its doors simply because you had a baby, unfortunately, and most restaurants are closed in the middle of the night.

On top of that, we are also making sure we have phone chargers, vape chargers (for my husband), and some essential toiletry items to clean up during our stay. This, according to many people, is a bare-bones hospital bag list, but it definitely works for us.

What did you pack when preparing for your own new arrival?

Read More

Pre-Baby Debt Update

We have less than two weeks before our baby arrives and things are falling into place. As mentioned in some of our recent posts, the main focus for us has been saving and preparing for the new arrival. That doesn’t mean we’ve stopped paying off debt by any means, but it hasn’t been a hyper-focus of ours in a few months. We are preparing to shift our focus back to paying off debt. Before we do, here’s a quick snapshot of where we stand.

Where We Stand

This year has brought some MAJOR changes for our family. First, my husband started pursuing a new career. He is freelance writing for several websites and is doing a phenomenal job! He has quickly caught up to my salary with what he is able to produce each month with his writing, which is fantastic. This takes a lot of the financial burden off of us and will make it easier to pay off debts and reach our goals.

Speaking of debts, it has been a while since I provided a numbers update. Here’s where we stand:

- Credit cards: $451 – This will be paid off in full soon.

- Collections: $1,213 – We are working on getting these removed.

- Car loans: $16,398

- Student loans: $24,185

We are continuing to take the federal student loan payment break during this time. Once payments resume, we will attempt to tackle that debt in a similar way that we plan to pay off the car (see below).

Plans for the Coming Months

There are some things changing in our finances over the next few months. Of course, we are having a baby. So, household expenses may be a bit higher than they have in the past. Additionally, we will need to add our little one to the health insurance. We are also looking into purchasing life insurance just in case something was to happen to one of us.

On top of those additional expenses, our rent is also going up by $110 per month. This is to renew it another year. If we were to renew for two years, it would go up another $140. Neither of us wanted to make a two-year commitment to renting here, so we are going with the one-year renewal. So, our rent is going from $1,495 to $1,605 (plus the $25 pet rent). Hopefully, within a year, we will have some savings and enough debt paid down to look at buying a home.

Our car payment is another big monthly expense we are hoping to trim down. The car still has under 75,000 miles and we will drive it for several years. However, the $488 monthly payment can be crippling. So, we are hoping that my hubby’s additional income will help us pay it off sooner. We hope to double the monthly payment and get it paid off within the next year or so.

Outside of that, we are going to continue trucking along our financial journey with our new baby. We can’t wait to keep you updated on our progress!

Read More

Debt Update: May 2021

If you are a regular follower of Our Debt Free Family you may have noticed there hasn’t been a hard numbers debt update from us in a while. Honestly, with COVID-19 last year, moving, and then finding out we are expecting a child, our debt progress hasn’t been front-and-center like it used to be. However, that doesn’t mean we haven’t still been making progress.

Debt Update: Where We Stand

As of May 2021, we are holding about $42,000 in total debt. Here is the breakdown…

- $525 credit card debt

- $621 in collections

- $24,185 student loans

- $16,842 car loan

Considering where we started just a couple of years ago, we have paid off more than $20,000 in debt. That is great progress, but we thought we’d be so much farther along by now. Last year, my husband lost his job and then switched careers. I have been taking advantage of the break from student loan payments, for now, trying to save for our new baby (and praying for student loan forgiveness to pass). We’ve been paying minimums on everything else just trying to get caught up from last year and the move.

All in all, that’s okay for us. We’ve stayed afloat and that’s more than a lot of Americans can say after the cards that were dealt to many people in 2020. For that, I am thankful.

Goals

So, what’s next for us?

We certainly want to shift our focus back towards paying off more debt. Of course, having the debt paid off means more cash flow month-to-month. More specifically, we’d like to pay off the car loan and free up the $488 per month we make in payments there. With the new arrival coming, our main goals have been focused on saving money and preparing though.

Some of our main goals right now include having a substantial emergency fund stashed away before the baby arrives, paying off all the credit card debt, nixing the new phone upgrades in September to save money on our bills, stocking up on items for the baby and food so we have lower month-to-month expenses when she arrives, and creating a nice space here in our home. We haven’t gotten much of a chance to settle in yet over the past few months. We are still in need of a dresser for our room, for instance. My husband needs a desk (so we don’t have to share one) and we need a frame for our bed.

Once all of those things are properly tackled, we are going to focus on doubling up on our car payment every month to hack away at that quicker. If we are successful, it should help us have it paid off within a year (a full two years early). Then we will shift our focus to getting the rest of our finances in order to hopefully buy our own home and save a good chunk of the $1,520 in rent we pay each month.

While we haven’t made the progress we were hoping for by now, the debt freedom journey is always humbling. You have to go with the flow and shift your focus as needed.

Read More

Our Monthly Debt Freedom Progress Report — February

Each month I bring you a recap of the previous month’s progress on paying off our debt. This serves two purposes — to keep my husband Mike and me accountable to our financial goals and to give you a look behind the scenes of our strategy for paying off our debt.

Our Monthly Debt Freedom Progress Report — January

Each month I am going to bring you a recap of the previous month’s progress on our debt freedom plan. This will serve two purposes — to keep my husband Mike and me accountable to our financial goals and to give you a look behind the scenes of our strategy for paying off our debt. [Read more…]